Covid-19 continues to pose challenges for households and businesses

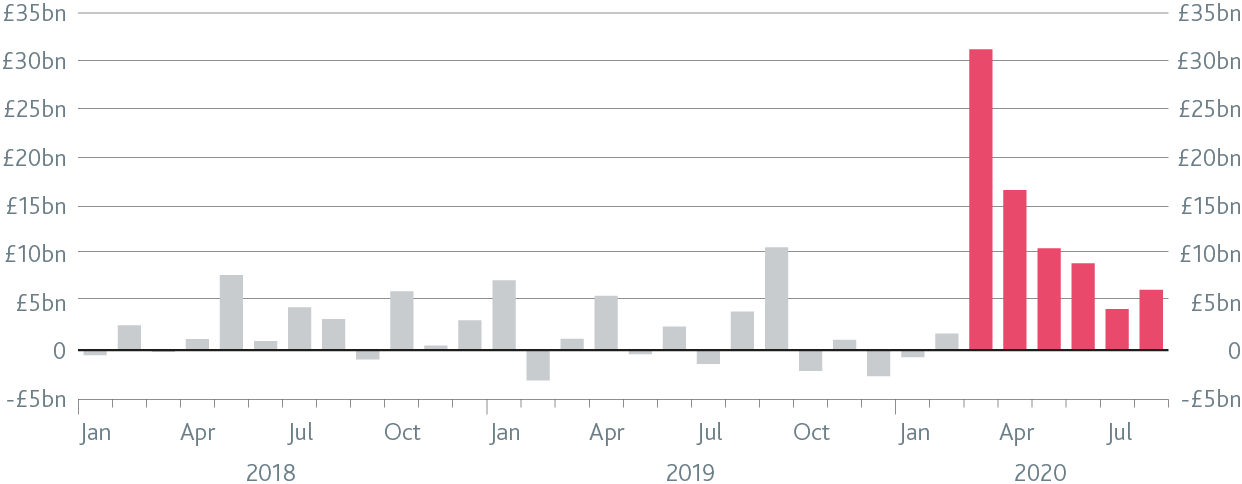

Covid-19 has put a big strain on UK businesses’ earnings, and is threatening the livelihoods of many people. The recent increases in Covid-19 cases, and associated public health measures, have the potential to weigh further on economic activity.

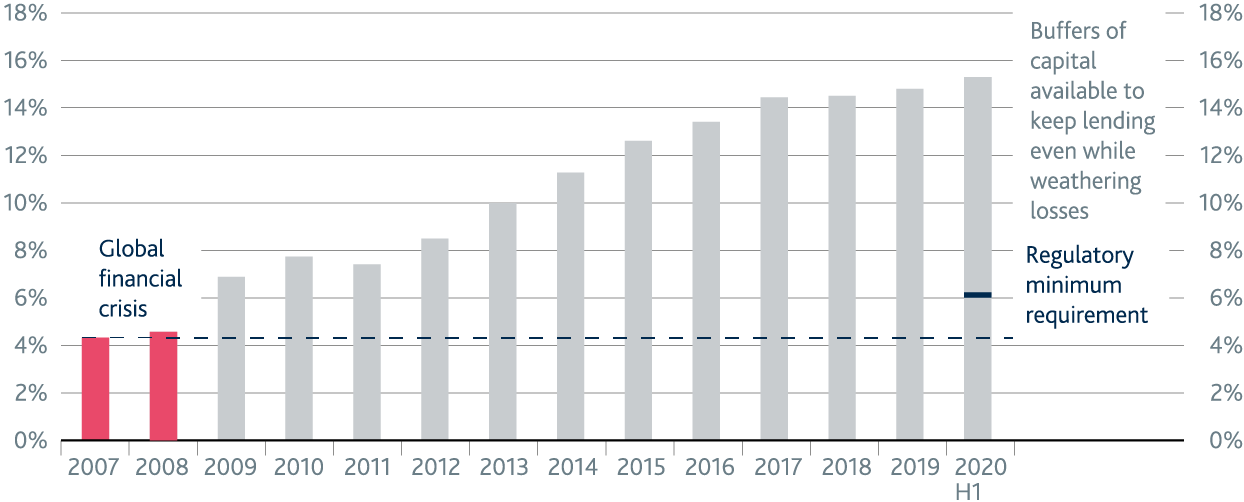

Households and businesses have needed help from banks and financial markets to weather the economic disruption associated with Covid-19. Since the global financial crisis in 2008, we’ve taken actions to strengthen the UK financial system. As a result, UK banks are strong enough to keep supporting households and businesses through this difficult period.