We are the UK’s central bank, a publicly owned body. It’s our job to:

- keep the cost of living stable (while supporting the economy and jobs)

- make sure the UK’s financial system can withstand shocks

- make sure UK banks and other financial firms are safe and sound

Since the start of the Covid crisis, we’ve been supporting the economy by helping businesses so they can keep as many people in work as possible.

We also want to do as much as we can to reduce any longer-term damage to the UK economy.

To support the UK economy, we have:

Why did the Bank of England cut interest rates?

We cut interest rates to help reduce the cost of loans and mortgages for businesses and households.

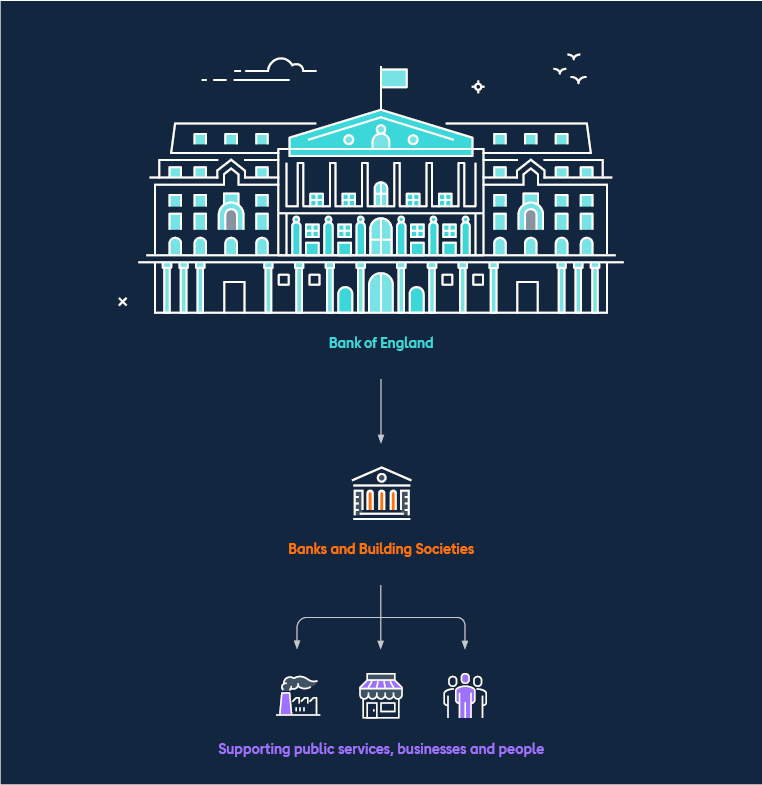

We can do that because we’re the UK’s central bank. That means we provide banking services to all the banks and building societies in the UK.

They can hold accounts with us and borrow money from us. We charge them for that (in the form of interest).

This means we can influence how much interest they charge you. If we reduce our rates, banks and building societies tend to reduce theirs and vice-versa. It’s a useful thing we can do in situations like this.

In March 2020, we cut our interest rate to almost zero (0.1%). Banks then cut their interest rates so businesses and households face lower borrowing costs.

We know this change won’t help everyone directly as many people don’t have loans or a mortgage. But we know the interest cut will support the economy overall.

We have also helped to reduce the borrowing costs of households and businesses through quantitative easing.

Why is the Bank of England helping banks?

Banks and building societies play an important role in the UK economy. Many people, businesses and public services rely on them. For example, businesses sometimes need to borrow money to invest and grow.

At the start of the coronavirus lockdown, we reduced the amount we charge banks for services we provide to them so they could reduce how much they charge their customers. It’s another way we can help reduce the costs people and businesses in the UK face.

Those banks have agreed not to pay any outstanding 2019 profits (known as dividends) to their shareholders and not to pay any new dividends until the end of 2020.

We also expect banks not to pay cash bonuses to their senior staff. So they have more cash available to lend to businesses and households.

Why is the Bank of England giving loans to large businesses?

The companies we offered loans to employ 2.5 million people in the UK.

And some run essential services like providing gas and electricity.

They included household names such as the National Grid, John Lewis, Marks and Spencer and the National Trust.

We did this so these companies could keep paying wages and suppliers even if they had cash-flow problems.

Many companies, including those just mentioned, have now paid back the loans. All loans are due for repayment by March 2022.