Overview

In monetary and financial statistics, a distinction is made between changes in amounts outstanding of financial instruments that are due to transactions, and those that are due to other changes in assets. This distinction forms a standard part of the international statistical guidelines, such as the European System of Accounts (ESA 2010)1, where the latter category comprises ‘other changes in the volume of assets and liabilities’, and 'holding gains and losses'. For convenience, these categories are combined and referred to as other changes in the value of assets (OCVA).

Transactions means the net change in balances over a reporting period that is attributable to the economic or financial behaviour of households, businesses or other entities in the sectoral definition – e.g. putting more money into a savings account, or repaying a business loan. Other changes in the value of assets (OCVA) means the effects of changes in definitions, statistical re-classifications, write-offs, revaluation effects and such like. In accounting terms:

Closing balance = opening balance + transactions + other changes in value (OCVA)

For typical monetary aggregate series, the Bank of England publishes data on the amount outstanding ('levels'), the change in amount outstanding due to transactions, and growth rates. Series identifiers and table headings mainly use the terminology: Monthly changes of... to refer to transactions, and in fact the term transactions is not typically employed. Flows and net flows are equivalent terms which are also used. Each of these expressions should be understood to be synonymous with transactions.

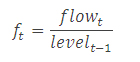

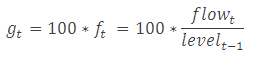

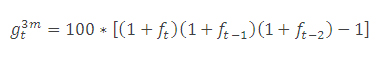

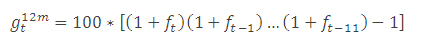

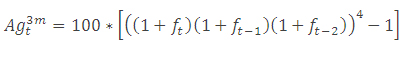

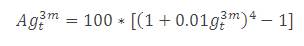

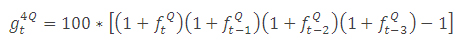

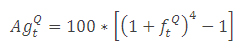

For growth rates, the view is taken that these are generally more meaningful once the impacts of other changes in the value of assets (OCVA) have been removed from the calculation, so that they are not distorted by breaks in series. Growth rates are therefore calculated from flows and previous period amounts outstanding. The one-month growth rate is calculated as the flow during the month expressed as a percentage of the amount outstanding at the previous month. Longer period growth rates, e.g. 3-month and 12-month growth rates, are calculated by compounding the one-month growth rates of the current and preceding months.

It is important to appreciate that this calculation of growth rates can differ from the alternative calculation derived from amounts outstanding data for the current and original periods. Differences between these methods of will arise because of the exclusion of OCVA effects.

Table 1: Terminology and definitions

| Bank of England statistics | ESA 2010 |

| Amount outstanding | Closing balance |

| Previous amount outstanding | Opening balance |

| Flow (or 'change) | Transactions |

| Growth rate, over a single period | = Transactions / opening balance |

| Growth rate, over multiple periods e.g. 12-month rate | = Single-period growth rates, compounded |

| Break | Other changes in assets |

| Break adjustment (for calculating flows and growth rates) | Offset to 'other changes in assets' effect |