Tower Hamlets Town Hall blog

The Bank of England has been rooted in the centre of the world’s leading financial hub, the City of London, for the last 325 years. We are dedicated to the same mission today as when we started: to promote the good of the people of the United Kingdom. Today we do this by maintaining monetary and financial stability.

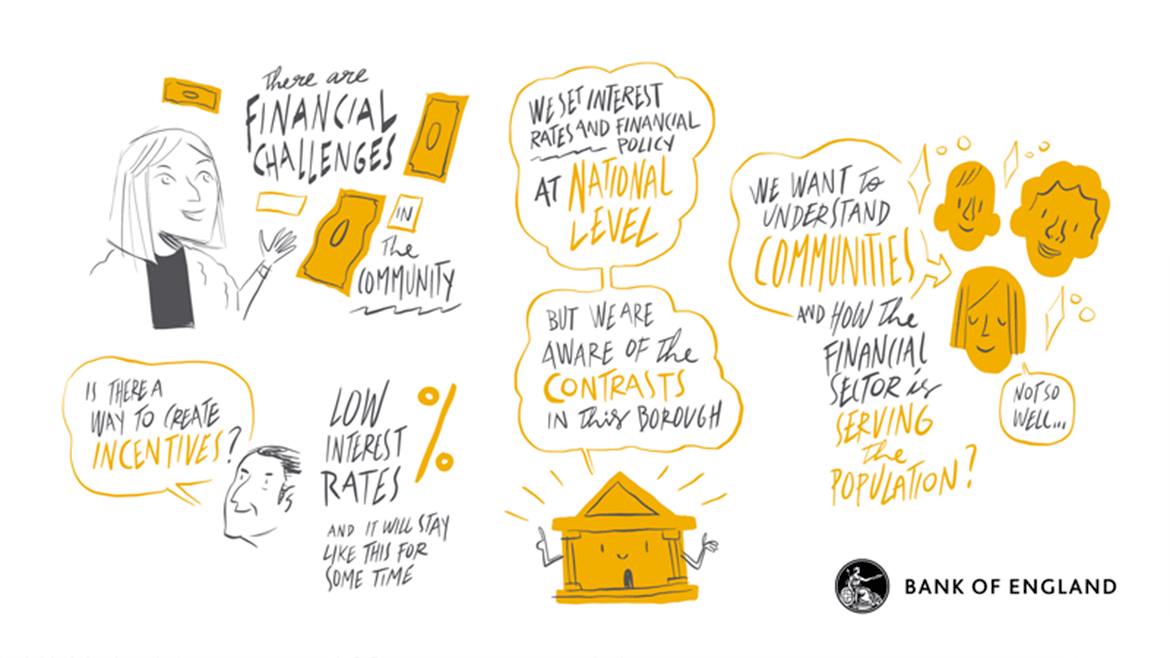

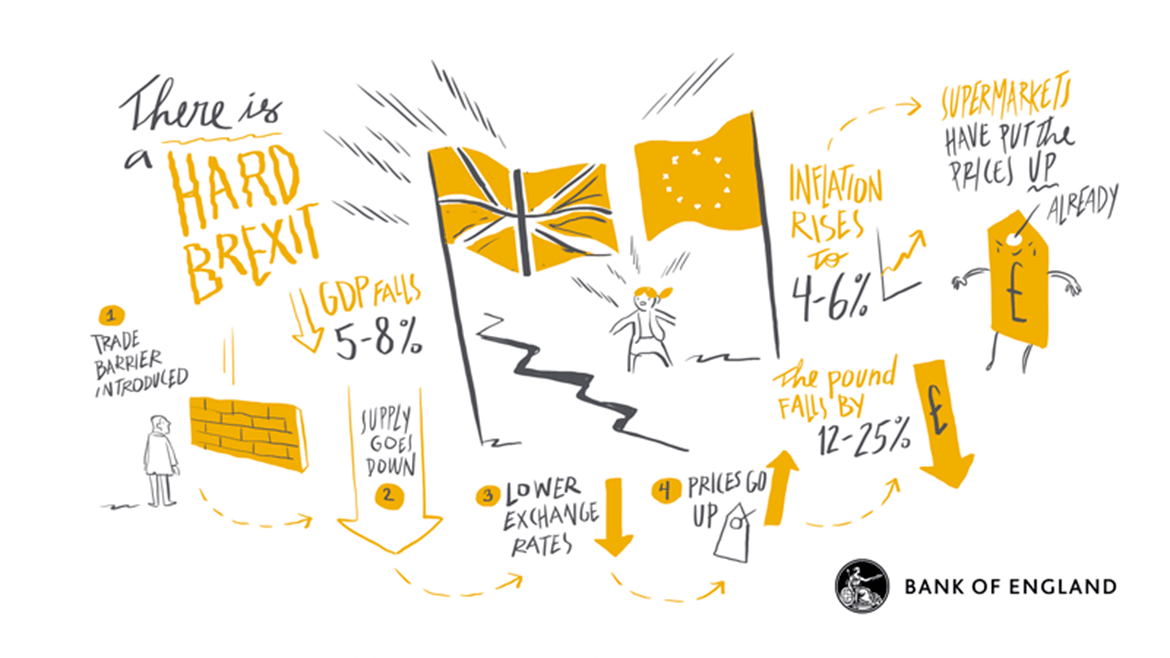

That means ensuring prices don’t rise too fast, as the ill effects of high inflation fall predominantly on the poorest in society. It also means making sure the financial system is safe and sound, keeping people’s hard-earned money secure and providing households and businesses with the financial products – insurance, banking and investments – they need in good times and bad. We deliver this mission by focusing on the national level; for example, we set interest rates for the country not the county.

But, we are also working on a number of projects at local levels, to understand better the impact of our policies, to explain the Bank’s work to interested parties and to ensure that we are engaged in our own community.

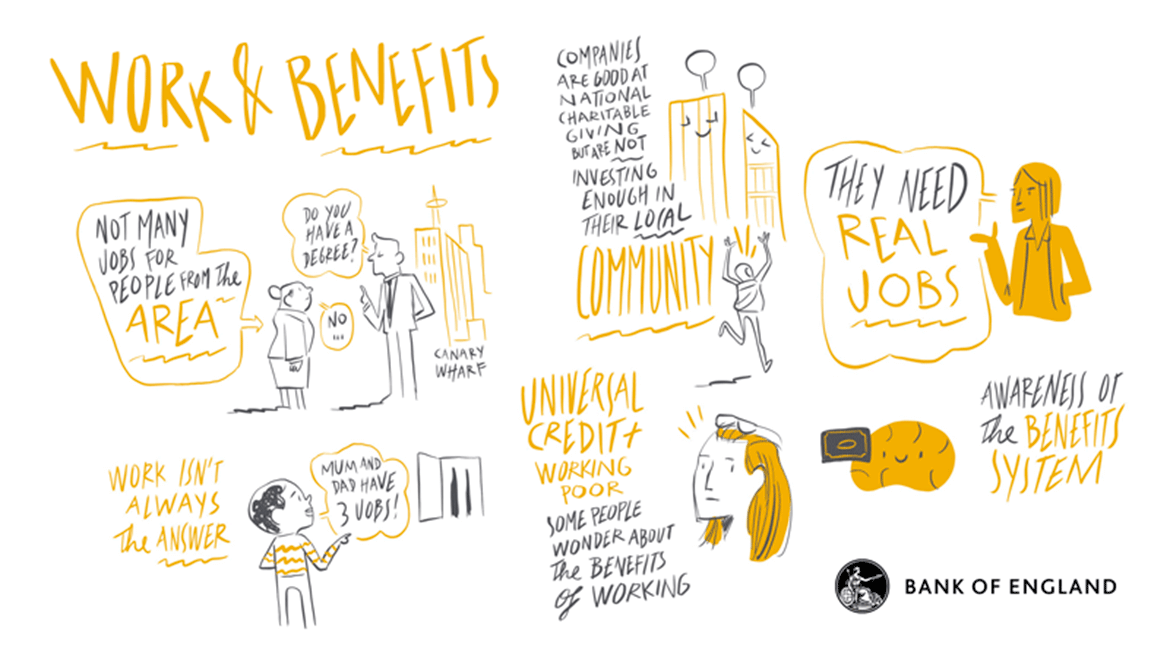

Recently, as part of the Bank’s outreach programme, I visited Tower Hamlets. I went to a local school to explain the Bank’s work, answer questions about a range of topics from financial crises to diversity, and hopefully to prompt a few students to consider careers in finance – even central banking. After the intense Q&A, I met local community leaders and money advisers at Toynbee Hall, before heading out to Well Grounded, a social enterprise moving people out of unemployment and improving their wellbeing through a comprehensive barista training course.

As I discovered, there was plenty to be proud of in the local community. The students I met were bright and engaged, the questions formidable, and the school facilities second to none. Educational attainment in the Borough is now above the national average. Last year, two thirds of pupils achieved 5 or more A*-C grade GCSEs. There are 60,000 more jobs in the area than there are residents of working age. And the number of homes in Tower Hamlets has increased by a third since 2003 and right now, it has the highest number of homes under construction in London.

This is however a borough of contrasts. Many of the flats in those gleaming towers will be sold to non-residents. Child poverty is still at 40%. And one in two older people lives in income deprivation, the highest rate in the UK.