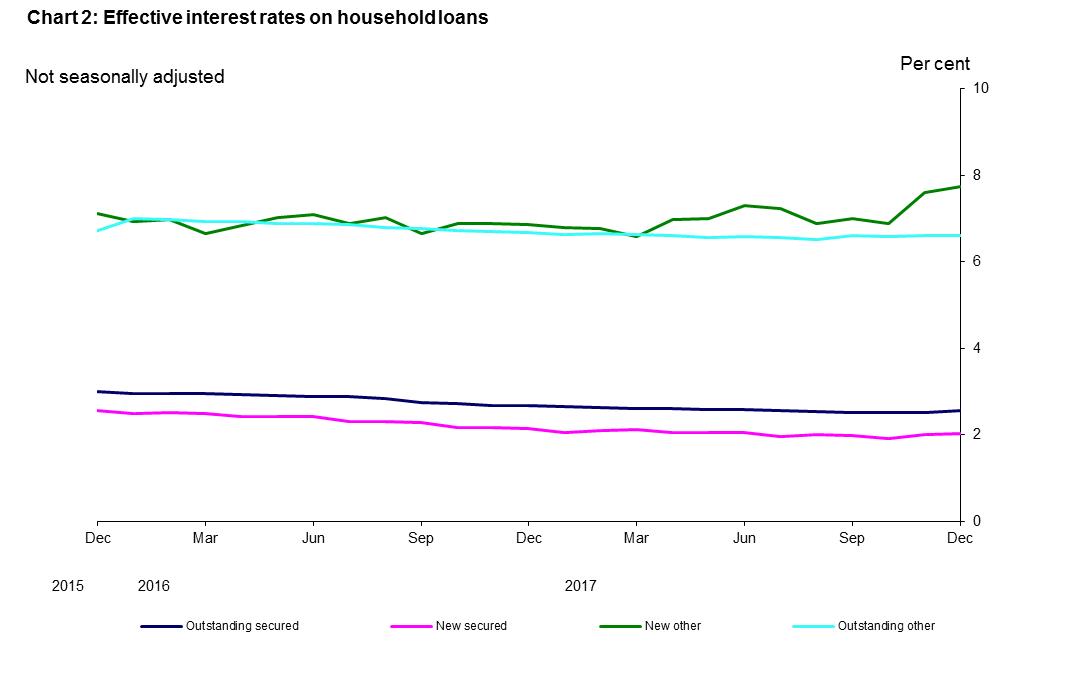

- Effective rates on new and stock individual floating-rate mortgages have increased by 24bps from 1.75% to 1.99% and 19bps from 2.60% to 2.79% respectively, showing pass through of the Bank Rate rise in November.

- Effective rates on new fixed-rate other loans to individuals have all increased in December, the fixed-rate 1 – 5 years rate increased by 20bps from 7.94% to 8.14%.

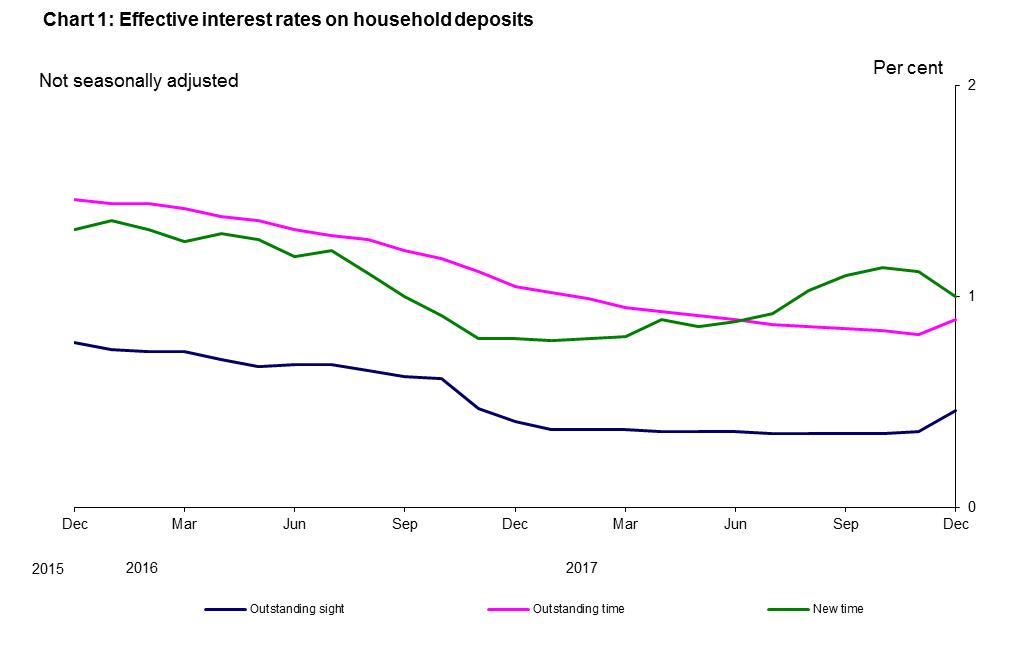

- Effective rates on individual stock deposits have increased; sight deposits increased by 9bps from 0.37% to 0.46% and time deposits increased by 7bps from 0.82% to 0.89%.

Table A: Effective interest rates paid/received on individual's balances by UK MFIs (excluding central bank)

Per cent

Not seasonally adjusted

| Outstanding | New business | |||||||||

| Sight deposits | Time deposits | Other loans | Secured loans | Time deposits | Other loans | Secure loans | ||||

| Z6IQ | Z6IW | Z6KO | Z6K6 | Z6IH | Z6K5 | Z6JM | ||||

| 2017 | Sep | 0.36 | 0.85 | 7.15 | 2.52 | 1.11 | 7.18 | 1.97 | ||

| Oct | 0.36 | 0.84 | 7.11 | 2.50 | 1.15 | 7.03 | 1.92 | |||

| Nov | 0.37 | 0.82 | 7.10 | 2.50 | 1.15 | 7.83 | 1.99 | |||

| Dec | 0.46 | 0.89 | 7.07 | 2.55 | 1.01 | 7.96 | 2.02 | |||

Table B: Effective interest rates paid/received on PNFC balances by UK MFIs (excluding central bank)

Per cent

Not seasonally adjusted

| Outstanding | New business | ||||||

| Sight deposits | Time deposits | Loans | Time deposits | Loans | |||

| HSCT | HSCU | HSDC | BJ72 | BJ82 | |||

| 2017 | Sep | 0.14 | 0.42 | 2.81 | 0.29 | 2.41 | |

| Oct | 0.14 | 0.43 | 2.82 | 0.31 | 2.39 | ||

| Nov | 0.23 | 0.49 | 2.91 | 0.53 | 2.57 | ||

| Dec | 0.26 | 0.50 | 2.95 | 0.48 | 2.61 | ||