Blog

Alice Beagley, Museum Officer

Ever wondered what led to our foundation in 1694? Here's a quick explanation.

In short:

The Bank was founded because Charles II didn’t repay the debts he owed to goldsmiths.

"Hang on a minute," I hear you say. "Charles II wasn't even on the throne in 1694... what on earth has he got to do with any of it? And goldsmiths? Aren’t they a chain of high street jewellers?

So here's a more detailed explanation:

In the 17th century, early banking business was carried out by people known as the goldsmiths. They looked after and lent gold and silver to wealthy people, but they also charged really high interest rates. It was perfectly normal for the goldsmiths to charge interest rates between 20 and 30%.

However, in 1672, Charles II decided to borrow loads of money from the goldsmiths to keep him in the extravagant lifestyle he’d become accustomed to, but then decided that because he was King, he didn’t need to pay it back. So he wrote a letter to the goldsmiths with words to the effect of:

“Gentlemen, I’m an honest man but unfortunately I am unable to pay my debts back on this occasion. Sorry – will see what I can do.”

As a result, goldsmith businesses collapsed and confidence in the sector dissolved. Any goldsmiths who didn’t go under were, understandably, very reluctant to lend to monarchs after that.

Fast forward to 1693...

William III was desperately trying to raise funds for wars against France. He went to the remaining goldsmiths to see if any of them would fund him. They all said no, so William had to come up with a new way of raising the money.

The King discussed a number of ideas from the government, wealthy merchants and noblemen. But one of these came out on top.

William Paterson, a Scottish merchant suggested that members of the public could lend £1.2 million to the government (around £200 million today if you take inflation into account).

People who signed up to this scheme effectively became shareholders in a new joint-stock company. That means it was owned by the public and the government.

The company was called ‘The Governor and the Company of the Bank of England’. People invested in it by purchasing ‘bank stock’ and the government paid them 8% interest. It was a good deal for the government as goldsmiths charged lending rates of more than twice that amount!

And if that wasn't enough to tempt people to invest, the other selling point of this new ‘National Bank’ was that investors could be reassured that any money stored within our walls was safe from royal hands - what's not to like?!

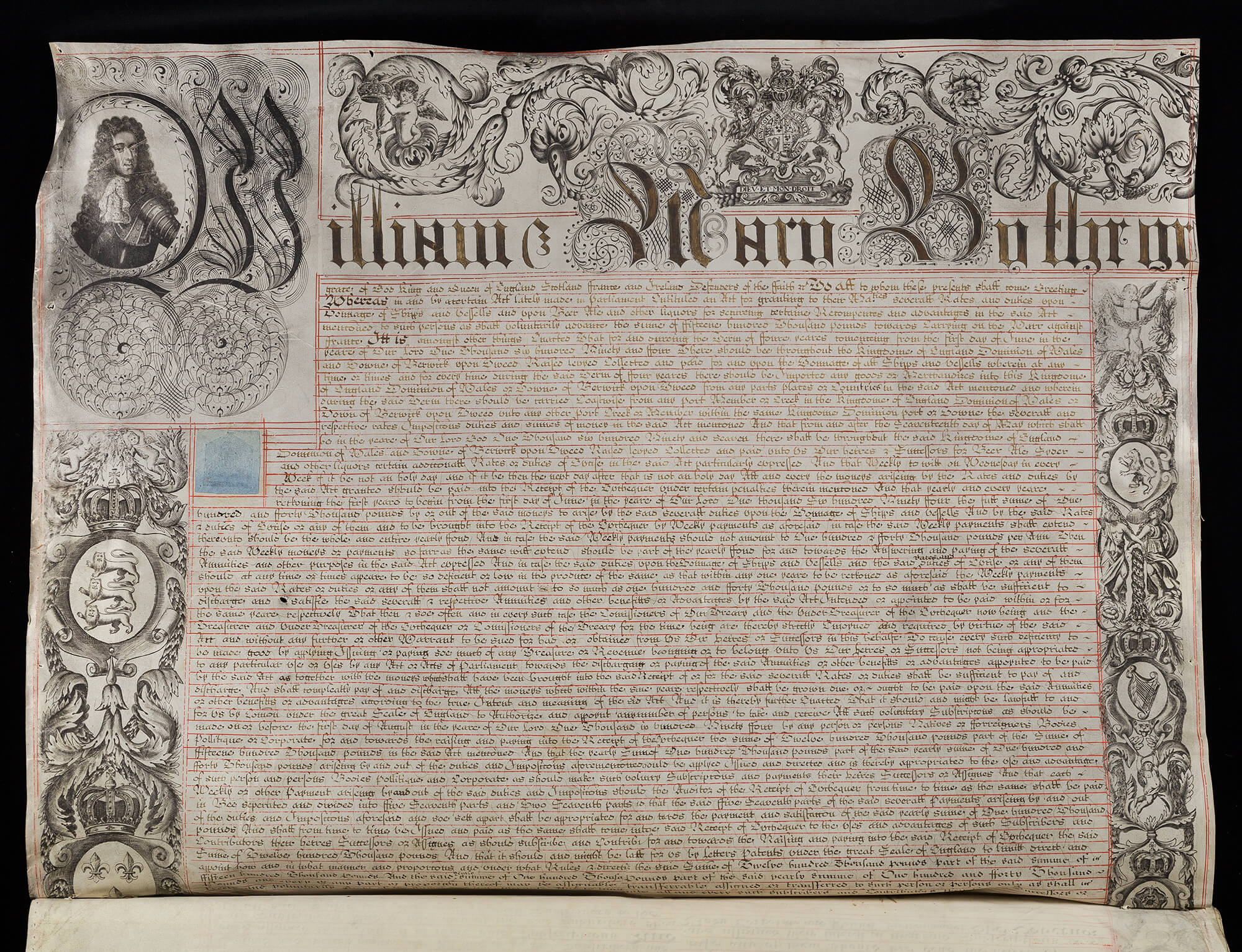

The £1.2 million target was raised in just 11 days by 1,268 members of the public from all walks of life. And we were formally established by Royal Charter on 27 July 1694.

The rest is history!