The marginal cost of funding is a key driver of banks’ lending rates.

Historically, banks have tended to use wholesale unsecured funding as their main measure of the marginal cost of funding. This is a useful indicator because it is a market in which it is possible to raise a large amount of funding relatively quickly and its cost is readily observable in terms of market pricing.

Supervisory intelligence, however, indicates that UK banks are now placing less emphasis on wholesale unsecured funding as their main measure of marginal funding costs for lending to households and companies. Most are using measures that take into account other sources of funding, such as covered bonds and retail deposits. Some banks are also taking into account targets for their margins and lending volumes.

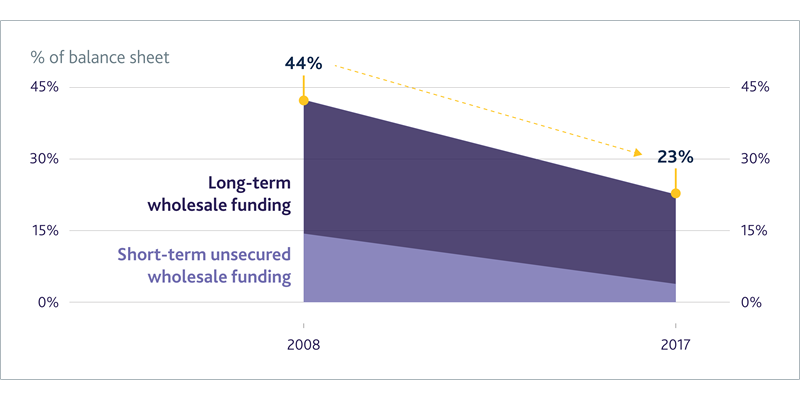

One reason for this is likely to be the substantial change in the structure of banks’ balance sheets since the financial crisis. Reliance on wholesale funding has fallen: the proportion of banks’ balance sheets accounted for by wholesale funding declined from over 40% in 2008 to less than 25% in 2017 (Chart A).