The CHAPS system is usually open from 6am to 6pm, Monday to Friday (excluding bank or public holidays in England and Wales).

What is CHAPS?

CHAPS is one of the largest high-value payment systems in the world, providing efficient, settlement risk-free and irrevocable payments. There are over 35 direct participants and several thousand financial institutions that make CHAPS payments through one of the direct participants.

Who uses CHAPS?

Direct participants in CHAPS include the traditional high-street banks and a number of international and custody banks. Many more financial institutions access the system indirectly and make their payments via direct participants. This is known as agency or correspondent banking.

CHAPS payments have several main uses:

- Financial institutions and some of the largest businesses use CHAPS to settle money market and foreign exchange transactions.

- Corporates use CHAPS for high value and time-sensitive payments such as to suppliers or for payment of taxes.

- CHAPS is commonly used by solicitors and conveyancers to complete housing and other property transactions.

- Individuals may use CHAPS to buy high-value items such as a car or pay a deposit for a house.

CHAPS Direct Participants

Banco Santander, S.A. (London branch)

Bank of America N.A. (London branch)

Bank of China Limited (London branch)

Bank of England

Bank of New York Mellon (London branch)

Bank of Scotland plc (part of the Lloyds Banking Group)

Barclays International (a trading name of Barclays Bank plc, part of the Barclays Group)

Barclays UK (a trading name of Barclays Bank UK plc, part of the Barclays Group)

BNP Paribas SA (London branch)

Citibank N.A. (London branch)

ClearBank Limited

CLS Bank International (an Edge Act Bank based in New York)

Clydesdale (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group)

Danske Bank (a trading name of Northern Bank Limited, part of the Danske Bank Group)

Deutsche Bank AG (London branch)

Euroclear Bank SA/NV (Brussels Head Office)

Fnality UK Limited

Goldman Sachs Bank USA (London branch)

Handelsbanken plc (a UK subsidiary of Svenska Handelsbanken AB)

HSBC Bank plc (part of the HSBC Group)

HSBC UK Bank plc (part of the HSBC Group)

iFAST Global Bank Limited

ING Bank N.V. (Amsterdam Head Office)

J.P. Morgan Chase Bank N.A. (London branch)

LCH Limited

Lloyds Bank plc (part of the Lloyds Banking Group)

National Westminster Bank plc (part of the NatWest Group)

Northern Trust Company (London branch)

Royal Bank of Scotland plc (part of the NatWest Group)

Santander UK plc (part of the Banco Santander Group)

Societe Generale (Paris Head Office)

Standard Chartered Bank plc

State Street Bank and Trust Company (London branch)

The Co-operative Bank plc

TSB Bank plc

UBS AG (London branch)

US Bank Europe DAC (UK branch)

Virgin Money (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group)

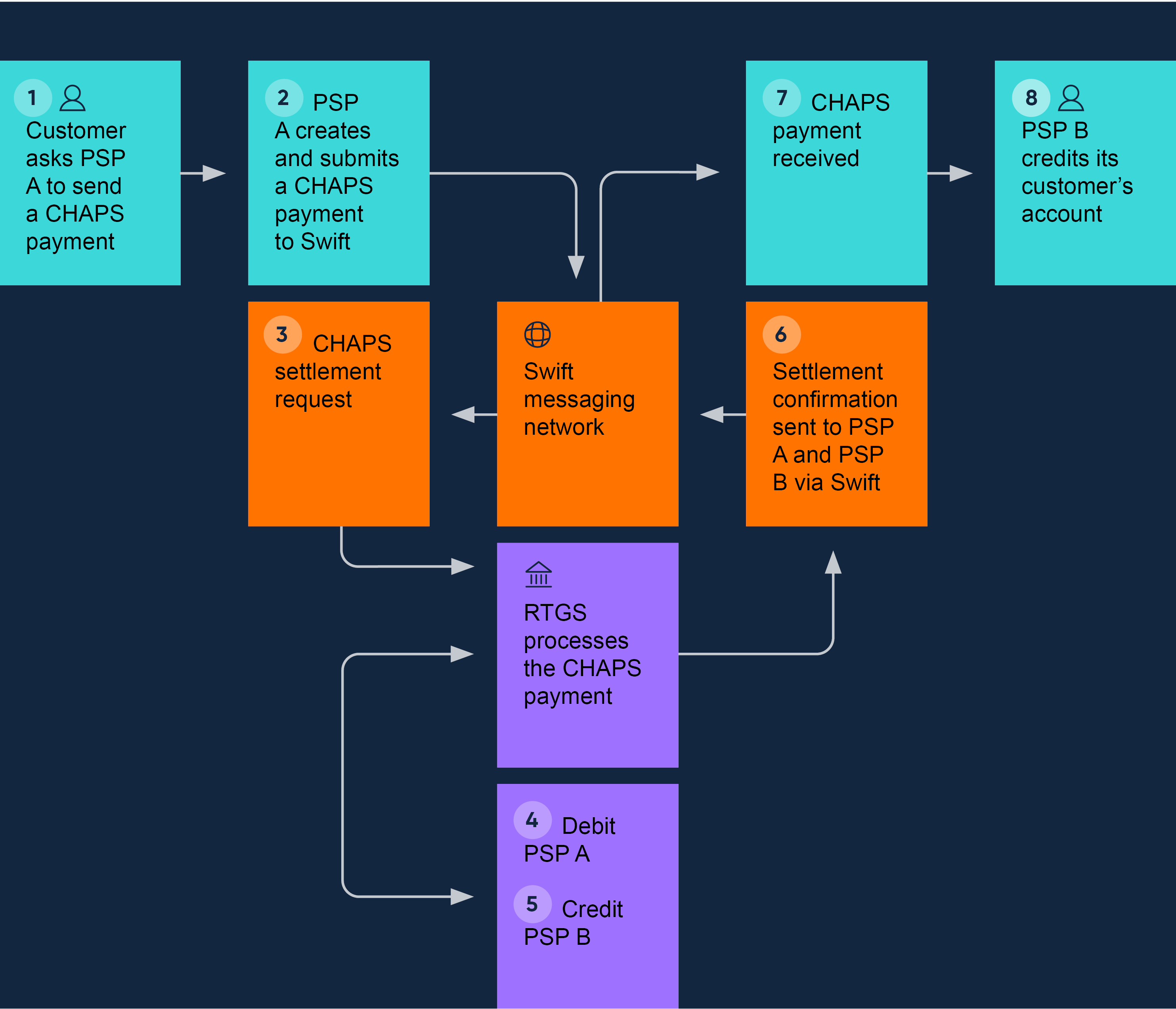

How does CHAPS work?

Payment obligations between direct participants are settled individually on a gross basis in RTGS on the same day that they are submitted. The transfer of funds is irrevocable between the direct participants.

Operating hours: The CHAPS system opens at 6am each working day. Participants must be open to receive by 8am and must send by 10am. CHAPS closes at 6pm for bank-to-bank payments. Customer payments must be submitted by 5.40pm.

What are the benefits of CHAPS payments?

Direct access to CHAPS supports secure and efficient provision of high value, same day payments from payment service providers to their customers. There is no minimum or maximum payment limit.

High level of operational resilience based on the Bank’s real-time gross settlement infrastructure and the SWIFT messaging network.

Settlement risk is eliminated between CHAPS direct participants, at the cost of an increased need for liquidity, making this model best suited to a high-value payment system with the largest potential systemic risk.

Requirements for Direct Access to CHAPS

To become and remain a CHAPS direct participant an organisation must meet certain criteria.

An organisation must:

- Hold an account at the Bank which may be used to settle payment obligations. Account access criteria are set out in the Bank’s access policy for RTGS settlement accounts and services.

- Be a participant within the definition set out in the Financial Markets and Insolvency Regulations 1999.

- If domiciled outside England and Wales, provide information about company status and settlement finality through a legal opinion.

- Comply with technical and operational requirements, including those set out in the CHAPS Reference Manual, on an ongoing basis.

The Bank operates a ‘trust and verify’ approach. Direct Participants must self-attest to their compliance with the CHAPS rules and requirements, and declare instances of non-compliance. The Bank may also seek to verify certain areas.

Technical requirements include access to the SWIFT network compromising one or more BICs, use of SWIFT InterAct Copy, appropriate interfaces to connect to the SWIFT network and process messages. Other important components are access to BERTI, the external user interface for RTGS and the Extended Industry Sort Code Database which is supplied by VocaLink.

The Bank, as the operator of CHAPS, has introduced rules as part of the CHAPS reimbursement requirement that has been put in place by the Payment Systems Regulator, with an effective date of 7 October. These CHAPS reimbursement rules form an annex to the CHAPS Reference Manual but are published as a separate document given the wider applicability. We are also publishing a list of indirect participants who should consider whether they are in-scope.

We have also provided explanatory notes, which includes details of the reporting process for in-scope CHAPS participants as well as a copy of the reporting form to be used.

Gaining access to CHAPS

The number of CHAPS direct participants increased by over 50% between 2015 and 2020 reducing risks to financial stability. The Bank regularly reviews its access policies to support wider access, including to support a more innovative and competitive market in payments, subject to where we can safely do so without impairing financial stability.

In February 2024, the Bank published a discussion paper on reviewing access to RTGS accounts for settlement. In April 2025, we published our response to this discussion paper.

The Bank, as operator of CHAPS, and a number of other UK payment system operators have published information to help organisations consider whether direct or indirect access best suits their needs.

Direct access to CHAPS

The typical timeline for joining CHAPS is around twelve to eighteen months from an initial meeting. Applicants must demonstrate their ability to meet the eligibility criteria set out in the CHAPS Reference Manual and comply with the technical and operational requirements. This is through a self-attestation model as well as technical testing. Applicants are also expected to provide information on their business model and rationale for seeking direct access to the CHAPS payment system. The Bank undertakes a series of risk assessments based on this information, including ahead of allocating a joining date.

In January 2022, a refreshed version of the CHAPS Reference Manual took effect. This was the final step in a programme of work to enhance the CHAPS Reference Manual. The new version is simpler, reduces duplication, and seeks to reduce the burden on CHAPS Direct Participants while maintaining an appropriate level of risk management. We also introduced sections on security and outsourcing; the latter facilitating the potential for CHAPS Direct Participants to use cloud-based solutions for processing CHAPS payments.

The renewed RTGS service has been built to support a substantial increase in the number of CHAPS direct participants – with a simpler and more proportionate joining process than previously. For example, testing will be streamlined for new joiners as well as existing CHAPS direct participants.

The next available joining date for CHAPS is likely to be in 2026. The earliest of these slots are likely to be allocated to a small number of organisations who have already engaged with us on future direct access to CHAPS. We continue to welcome expressions of interest for direct access to CHAPS from eligible organisations who want to understand the relevant rules and future technical requirements with a view to being ready to join in 2026, give the typical timeline for joining CHAPS is around twelve to eighteen months.

Indirect access to CHAPS

For those interested in indirect access, Access to Payments includes a list of Indirect Access Providers and details of their offerings.

Cost of Direct Access to CHAPS

The cost of direct participation in CHAPS includes one-off set-up costs, such as the cost of developing the necessary hardware, software and processes to connect to CHAPS and establishing sufficient expertise amongst staff. They also involve a potentially significant level of ongoing cost, such as fees and other participation costs; opportunity costs of providing collateral or holding liquid assets; hardware and software maintenance; and higher staffing costs.

We charge CHAPS Scheme fees to Direct Participants with an annual participant charge and a per-item fee. We do not charge a joining fee but certain costs, such as external legal fees, may be recovered from Direct Participants.

Other costs that CHAPS Direct Participants can expect to incur are:

- VocaLink charges for status changes within the Extended Industry Sort Code Directory (EISCD).

- SWIFT tariff fees and charges for CHAPS payment and advice messages.

- Regulatory fees, including from the Payment Systems Regulator.

- Hardware and software costs such as a payments gateway or using the services of a technical aggregator.

CHAPS payments for customers

Indirect participants access the CHAPS system through one of the Direct Participants based on a commercial and contractual arrangement. The Direct Participant makes and receives payments on behalf of indirect participants and other customers including business and individuals.

- Various organisations provide advice to help prevent fraud and implement security policies to help reduce the risk of successful cyber-threats. For issues with specific payments, users should contact their bank, building society or other payment service providers.

- On 7 June 2023, the Payment Systems Regulator published its final policy statement on Fighting Authorised Push Payment Fraud. This set out its new reimbursement requirement for authorised push payment fraud within Faster Payments. The reimbursement requirement is supported by 10 key policies.

- The Bank, as the operator of the CHAPS payment system, is committed to achieving comparable outcomes of consumer protection for retail CHAPS payments while also reflecting the unique characteristics of CHAPS as a wholesale payment system. We are working with the Payment Systems Regulator and CHAPS Direct Participants, as well as other key stakeholders, to deliver this. The approach is through a combination of directions from the PSR to CHAPS participants as well as changes to the CHAPS rulebook. Draft versions of the rules have been published and are largely aligned with those for Faster Payments. On 6 September, the Payment Systems Regulator published PS24/5 CHAPS APP scams reimbursement requirement. This set out the final details of the CHAPS reimbursement requirement, with a start date of 7 October 2024. All in-scope PSPs must register for access to a directory in order to manage claims with other Payment Service Providers. The Payment Systems Regulator also published the CHAPS compliance data reporting standards which sets out the data that Payment Service Providers must report.

- The model for CHAPS covers participants who process CHAPS payments for UK retail use, and includes an upper limit for the value of reimbursement claims.

- On 19 December, the Payment Systems Regulator confirmed that a maximum reimbursement level of £415,000 would apply for authorised push payment scams across Faster Payments in Fighting authorised push payment scams: final decision. For consistency, the Bank set out that it would apply a maximum reimbursement level of £415,000 per claim for UK retail CHAPS payments as well. The Payment Systems Regulator said it would monitor the incidence and impact of high value scams and might review the reimbursement level ahead of October 2024 if there is convincing evidence to do so.

- On 4 September, the Payment Systems Regulator published findings from its review of high value APP fraud claims for Faster Payments. After considering the findings as well as evidence from the industry, the Payment Systems Regulator decided to consult on a new maximum reimbursement level for Faster Payments. Its proposal was to align with the current Financial Services Compensation Scheme (FSCS) limit of £85,000. On 26 September, it announced that its Board had decided that the limit would be £85,000 for Faster Payments.

- The consultation also sought feedback on the approach for CHAPS, and the responses put a strong emphasis on the importance of consistency with Faster Payments. To achieve this consistency, the Bank has set a maximum reimbursement level for authorised push payment claims for UK retail CHAPS payments at £85,000, aligning with the Payment Systems Regulator approach for Faster Payments. The Bank is committed to reviewing this limit in twelve months.

- In 2015, the Payment Systems Regulator found that indirect participants typically pay around £2 to £3 per CHAPS payment, with a maximum of £30. End-users typically pay between £25 and £30.

Other information

Transfer from CHAPS Co

Responsibility for the CHAPS system transferred to the Bank of England in November 2017. Board minutes from the CHAPS Clearing Company (the previous operator) are available through The National Archives.

Relationship with the Payment Systems Regulator

In January 2025, the Bank, as the operator of CHAPS, and the PSR updated an exchange of letters. The letters set out how the Bank and the PSR will continue to cooperate and coordinate, with the revisions covering the CHAPS reimbursement requirement and CHAPS reimbursement rules put in place by the PSR and the Bank respectively to support comparable protections against authorised push payment fraud for consumers using CHAPS and Faster Payments.