Exceptions

Exceptions to the Bank’s general approach

We have identified three key exceptions where the TTP will not be used to delay onshoring changes to firms’ obligations. We consider that granting transitional relief in these areas could undermine our statutory objectives. This means that firms will need to comply with these onshoring changes from the end of the transition period.

The three key areas where transitional relief is not available are:

a) Contractual recognition of bail in rules: We will not be granting transitional relief in respect of liabilities that are intended to count towards a firm’s minimum requirement for own funds and eligible liabilities (MREL), as this could undermine resolvability. In order to act proportionately, however, we will use the TTP in relation to phase two liabilities, as these have a lower potential impact on resolvability. Accordingly, firms will be required to include contractual recognition of bail-in terms in all new or materially amended liabilities, other than phase two liabilities, from the end of transition period.

b) Contractual stays: We will not be using the TTP in respect of new or materially amended non-UK EEA law governed financial arrangements in scope of the Stay in Resolution Part of the PRA Rulebook. This reflects the importance of these instruments in executing a resolution.

c) Financial Services Compensation Scheme (FSCS) protection: We will not be granting transitional relief to onshoring changes made to the Depositor Protection and Policyholder Protection Parts of the PRA Rulebook, which apply from the end of the transition period. To deliver effective FSCS protection, deposit takers must be able to deliver a Single Customer View (SCV) to enable payout by the FSCS in the case of failure; depositors must be aware of the changes in protection; and FSCS levies must be calculated on the basis of the changed scope. Otherwise, the aims of the FSCS regime and benefits to the stability of the financial system could be undermined.

The interaction between the temporary transitional power and other transitional or saving provisions

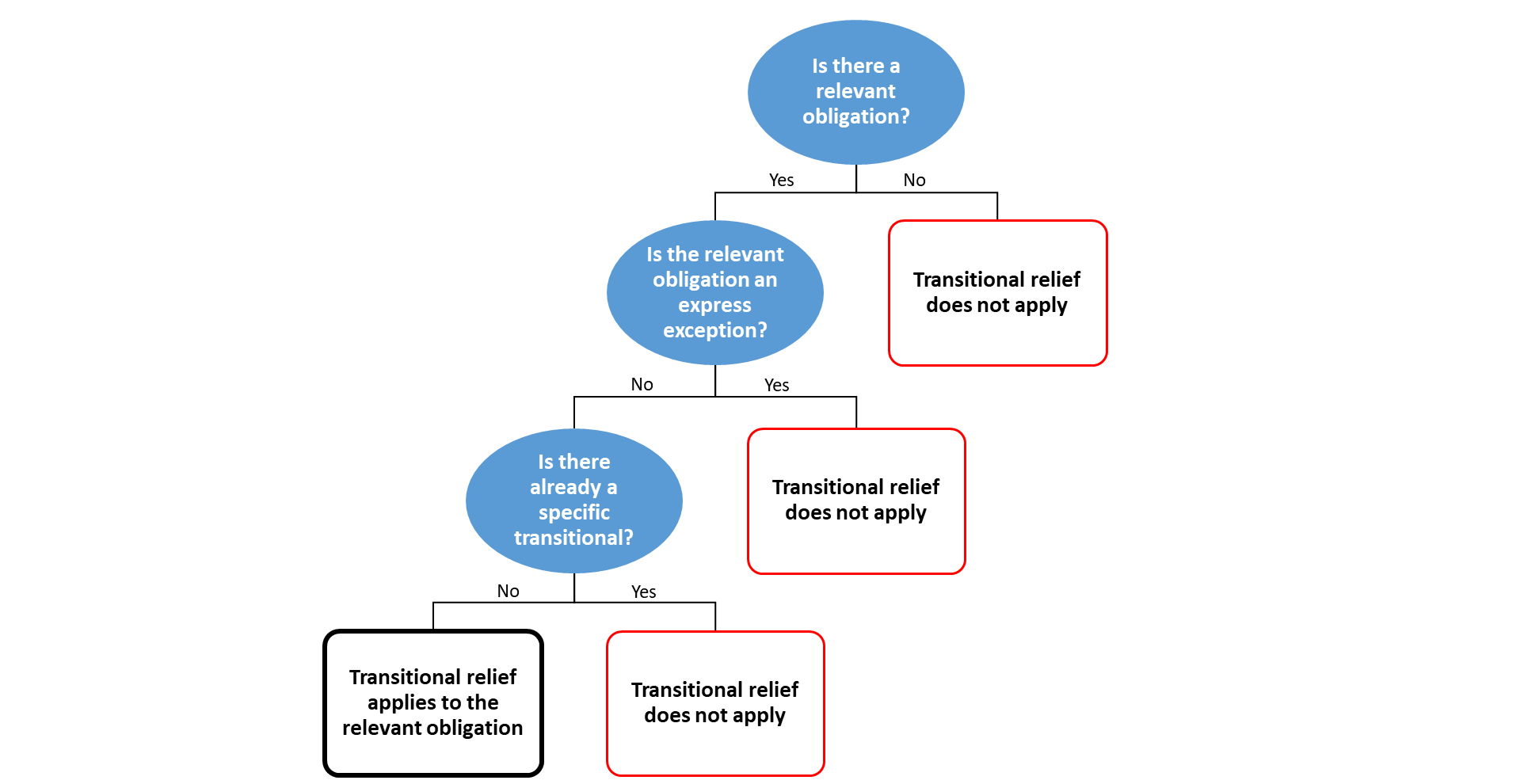

The TTP does not apply to any area where there is already a specific transitional or saving provision. This notably includes the temporary recognition and permission regimes, the financial services contract regime, and the use of Credit Ratings.

Specific transitional relief for firms in the temporary permissions regime (TPR) and the supervised run-off regimes (SRO)

For firms in the TPR and SRO, a specific set of transitional provisions applies. For more detail please see the ‘transitional relief for firms in TPR’ section in Temporary Permissions Regime and, the ‘transitional relief for firms in SRO’ section in Financial Services Contract Regime.

Specific transitional relief relating to credit ratings

The use of Credit Ratings is also subject to specific use of the TTP. Firms have been provided with a run-off period in which they can continue to use, for regulatory purposes, credit ratings issued or endorsed and not immediately withdrawn, before the end of the transition period, by EU credit ratings agencies without an affiliate which has registered with the FCA or applied for registration before the end of the transition period.

In this specific area, transitional relief is only provided for a period of 12 months after the end of the transition period. This time period aligns with the existing transitional provision in the Credit Rating Agencies (Amendment, etc.) (EU Exit) Regulations 2019 (the CRA SI), which provides for the continued regulatory use of ratings issued or endorsed, and not withdrawn, by EU CRAs with a group affiliate registered or applying for registration in the UK at the end of the transition period.

The cumulative effect of the run-off period applied by the transitional power and the separate transitional provision in the CRA SI is that UK firms may, for a period of one year after the end of the transition period, use a credit rating for regulatory purposes if it was issued or endorsed, and not withdrawn, by an EU credit rating agency before the end of the transition period.

Specific transitional relief for bilateral margining

To provide clarity, we have replicated the effect of the application of the general transitional power with specific amendments within the UK Technical Standard (UKTS) (the onshored regulatory technical standard (RTS)) on bilateral margining under EMIR. Firms can therefore continue to rely on existing operational and legal arrangements for compliance with this UKTS.

We have updated the end date of the specific transitional relief to Thursday 31 March 2022 to maintain alignment with the duration of the overall TTP period.

We highlight two aspects:

- Counterparties may choose to comply with the narrower UKTS requirements at any point during the TTP period. In many cases, the UKTS already provides firms discretion in how to comply with the requirements. For instance, firms may already accept a more limited range of collateral than permitted under the UKTS. This approach also allows firms to spread the operational challenges over the TTP period (ie 15 months) rather than concentrated at a single end date.

- The UKTS supplements transitional provisions provided for in the CRA SI (and the general use of the transitional tool with respect to credit ratings as set out above) to extend the transition for use of regulatory ratings to apply to non-financial firms. The specific transitional period within the UKTS is aligned with that of the CRA SI (ie 12 months).

In PS14/21 ‘Margin requirements for non-centrally cleared derivatives: Amendments to BTS 2016/2251’ the PRA and FCA extended the transitional as it applies to the eligibility of EEA UCITS as acceptable collateral. This was in response to submissions received to CP6/21, where respondents noted that exclusion of EEA UCITS may pose particular challenges to firms coming into scope of the 2021 and 2022 initial margin phases. This specific transitional provision has been extended until 31 December 2022.

Specific transitional relief for credit unions’ investments in the EEA

We have made a change to PRA rules so that credit unions will be able to hold EEA investments made before the end of the transition period to maturity (maximum of 5 years) but any (non-UK) EEA investments made after the end of the transition period cannot have a maturity that exceeds the TTP period.

We have updated the fixed end date of the transitional relief for credit unions’ investments in the PRA Rulebook to Thursday 31 March 2022, to maintain alignment with the duration of the broad temporary transitional power.

Additional exceptions specifically relating to PRA-regulated firms

Obligations relating to the Securitisation Regulation

The amendments made to the Simple, Transparent and Standardised (STS) framework in the onshored Securitisation Regulation already achieve the intended objective of the transitional power by removing barriers to a UK STS market which apply from the end of the transition period. We do not consider these onshoring changes to be disruptive for firms, and therefore obligations relating to STS securitisation are exempt from the use of the transitional power. This includes the modifications to Article 270(a) CRR and introduction of 270(aa) to the onshored version of CRR.

The transitional power will also not be used in relation to obligations relating to securitisation repositories. This is to ensure that UK regulators are able to exercise appropriate oversight of the UK securitisation market after the end of the transition period. Therefore, firms will be required to make information on securitisations which are not ‘private’ available through a securitisation repository registered by the FCA (where one exists) rather than to repositories based in the EU after the end of the transition period.

Accounting and audit legislation

References in PRA rules and onshored legislation to International Accounting Standards (IAS) should be read as references to EU-adopted IAS for the duration of the TTP period, until a firm moves from EU-adopted IAS to UK-adopted IAS for statutory accounting purposes. This exception to the use of the transitional power has been made in order to avoid firms needing to potentially refer to two separate accounting requirements: one for statutory accounts purposes and another for the purpose of complying with PRA rules and relevant legislation.

Technical information produced by EU authorities

EU authorities are currently responsible for the publication of various registers, lists and technical information. For example, the European Insurance and Occupational Pensions Authority (EIOPA) is responsible for publishing technical information under Article 77e of the Solvency II Directive that insurers use for regulatory valuations.

Where we are responsible for publishing that information after the end of transition period, firms should use information published by us, rather than continuing to rely on the EU information published by EIOPA. Therefore, transitional relief does not apply to firms’ obligations to use technical information published by the PRA after the end of the transition period.

Application of the transitional power to Capital Requirements Directive V (CRD V) and Bank Recovery and Resolution Directive II (BRRD II) derived legislation

No additional exceptions from the application of the transitional power are required in relation to onshoring changes to new rules and legislation implementing CRD V and BRRD II. The transitional power can only apply to the small number of changes resulting from the UK’s exit from the EU and not to changes implementing these Directives.

Additional exceptions specifically relating to FMIs

Central counterparty (CCP) obligations under the Markets in Financial Instruments Regulation (MiFIR)

The transitional power does not apply to any relevant obligations for CCPs under MIFIR and relevant BTS. We will not be using the transitional power in relation to areas in the onshored MiFIR where the effect of the transitional power could be achieved by HM Treasury making an equivalence decision or direction Where an equivalence decision or direction has been made, this will replicate the effect of applying the transitional power, and the area remains excluded from the use of the transitional power to avoid duplication.

Specific CCP obligations under EMIR

We will not be using the transitional power in relation to areas in onshored EMIR where the effect of the transitional power could be achieved by HM Treasury making an equivalence decision or direction. Where an equivalence decision or direction has been made, this will replicate the effect of applying the transitional power, and the area remains excluded from the use of the transitional power to avoid duplication.

The transitional power does not apply to the arrangements that the UK has put in place for the temporary and permanent recognition of CCPs. Specifically:

- The transitional power does not apply to the requirement for a third-country CCP to notify us of any material changes affecting the conditions of its recognition under Article 25(4) of EMIR or the requirement for a third-country CCP to submit a reasoned request to be assessed against Article 25a of EMIR.

- The transitional power does not apply to the CCP temporary recognition regime. Third-country CCPs providing clearing services under this regime are ‘deemed recognised’ under Article 25 of EMIR, and any relevant obligations need to be complied with as set out therein.

- The transitional power does not apply to third-country CCPs providing clearing services under the ‘run-off regime’ set out in the Financial Services Contracts (Transitional and Savings Provision) (EU Exit) Regulations 2019 (the FSCR SI).

Amended settlement finality regulations and the temporary designation regime

The transitional power does not apply to the arrangements that the UK has put in place to extend settlement finality protection to FMIs not governed by UK law and to certain third-country central banks. Specifically, the Financial Markets and Insolvency (Amendment and Transitional Provision) (EU Exit) Regulations 2019 are exempt from the use of the transitional power. These regulations give the Bank of England powers to grant permanent designation to FMIs that are not governed by UK law, and establishes a temporary designation regime for FMIs that are currently designated in other EEA states. We also have the ability to extend UK settlement finality protection for collateral security to certain third-country central banks.

Central Securities Depositories Regulation (CSDR)

The transitional power does not apply to the arrangements that the UK has put in place for the recognition of third-country Central Securities Depositories (CSDs). Specifically:

- The transitional power does not apply to the requirement for a third-country CSDs to notify the Bank of any material changes affecting the conditions of its recognition under Article 25(6A) of CSDR.

- Article 69 of CSDR, as amended by the Central Securities Depositories (Amendment) (EU Exit) Regulations 2018, is exempt from the transitional power. This exempts the transitional regime for third-country CSDs, which allows for continuity of settlement services following the UK’s withdrawal from the EU.