Highlights from the conference

We gathered a wide range of speakers to discuss what it means for a central bank to be free from political influence in London on 28-29 September 2017.

The Independence Conference marked 20 years since the Bank of England was granted independence to set interest rates. We wanted to take a step back and reflect on central bank independence, its practical application and future challenges.

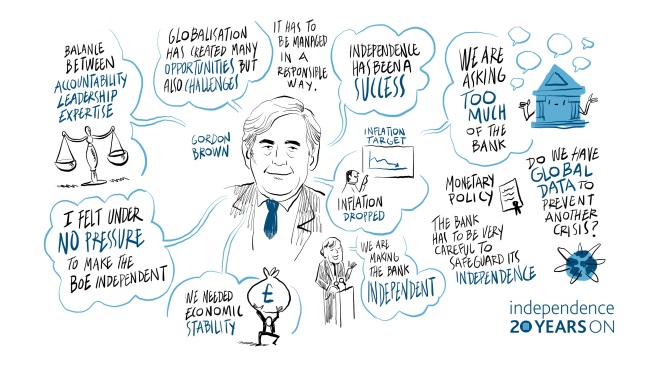

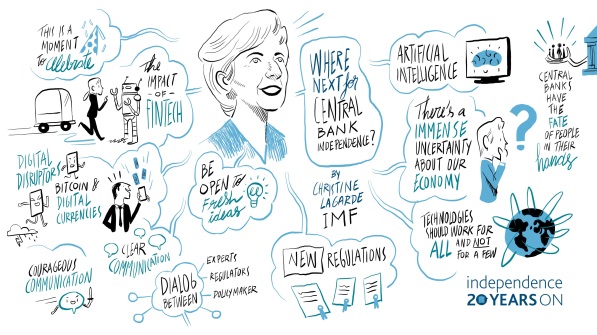

Speakers included the Prime Minister Theresa May, former Prime Minister Gordon Brown and managing director of the International Monetary Fund, Christine Lagarde.

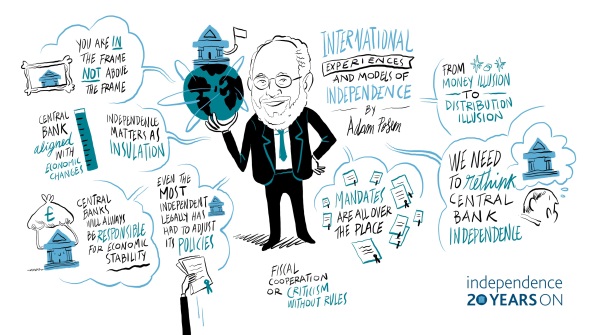

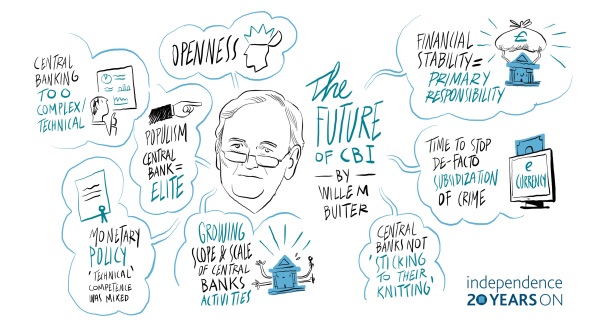

The event consisted of talks and panel discussions with observers, critics and other central bank practitioners.

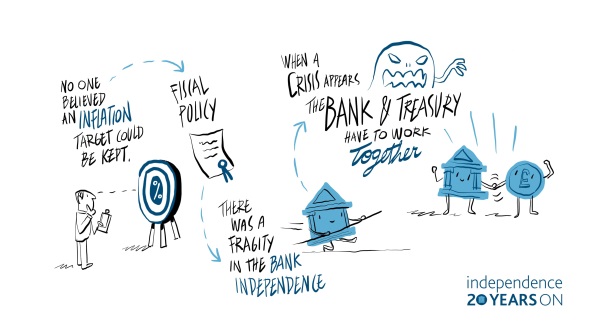

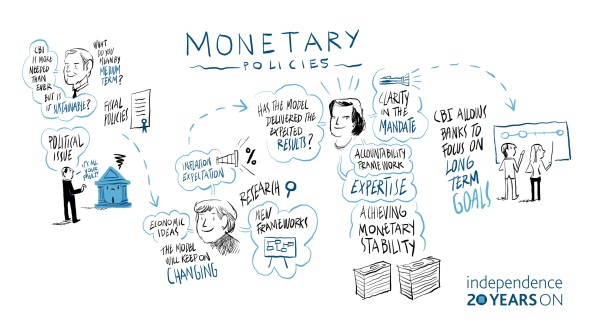

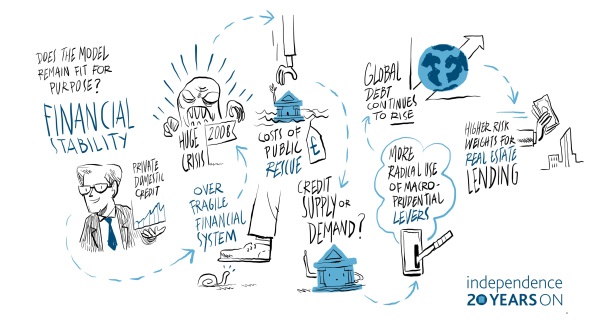

Since we were granted operational independence over monetary policy on 6 May 1997, our responsibilities have grown to include financial stability and regulating firms such as banks and insurers.

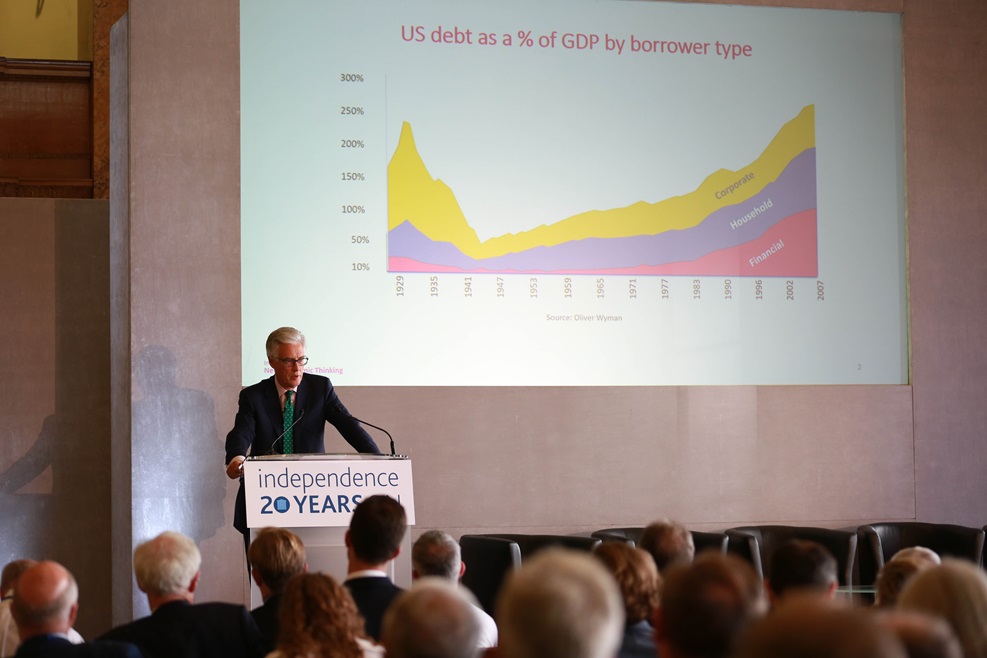

Couldn’t be there in person or just keen to delve deeper into the material? Don’t worry, it’s all here: videos, presentation slides and animated summaries of the speeches and panel discussions.