Andy Haldane's Town Hall blog: Ashington

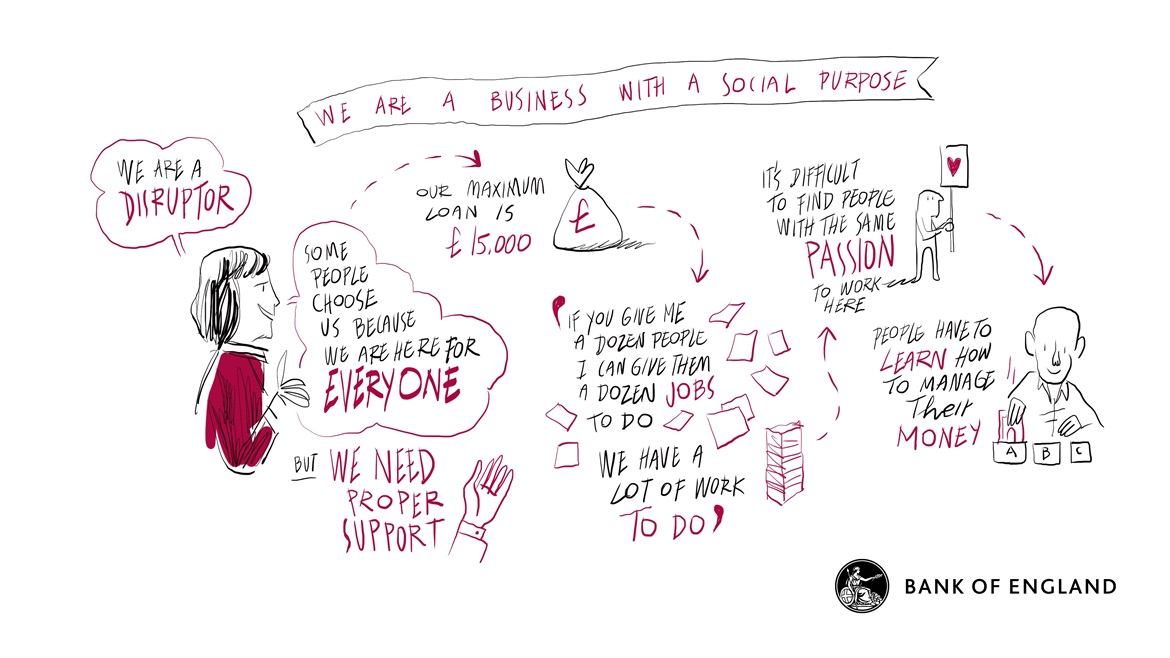

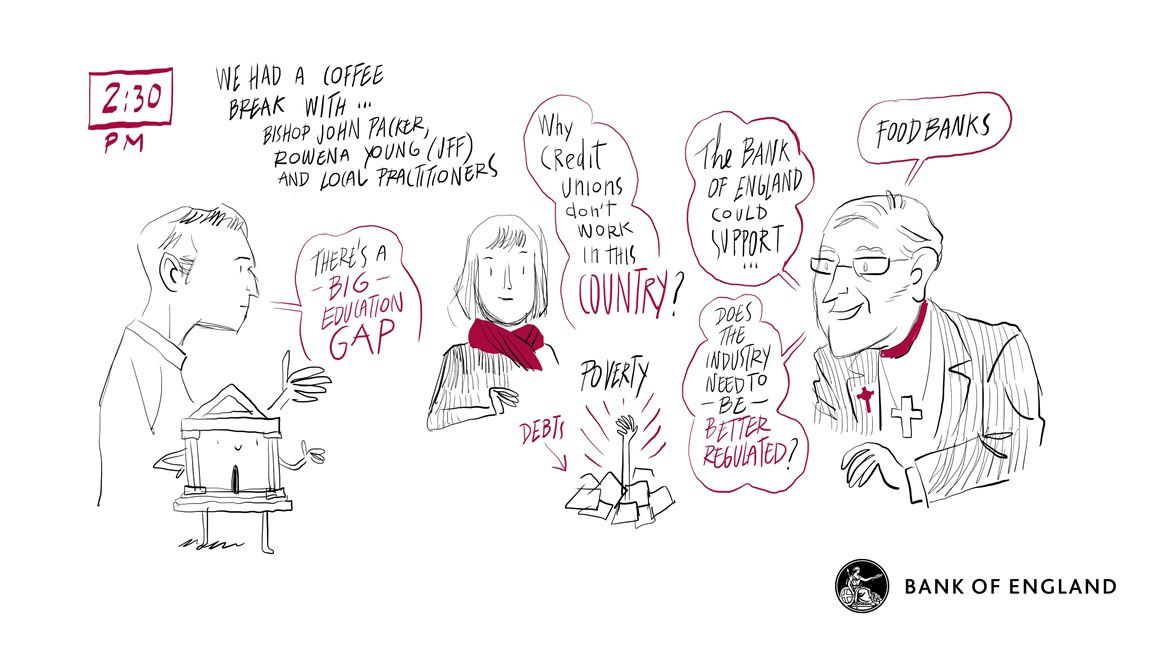

Last Friday, I went on the latest of my Town Hall visits to Ashington in Northumberland. The visit was organised in partnership with the Church of England and in particular their “Just Finance” foundation which does excellent work to support fair and affordable access to financial services across communities in the UK. The day involved conversations with teachers, pupils, parents, charities, credit unions, voluntary organisations, local councils, companies and housing associations, as well as Church of England staff and volunteers.

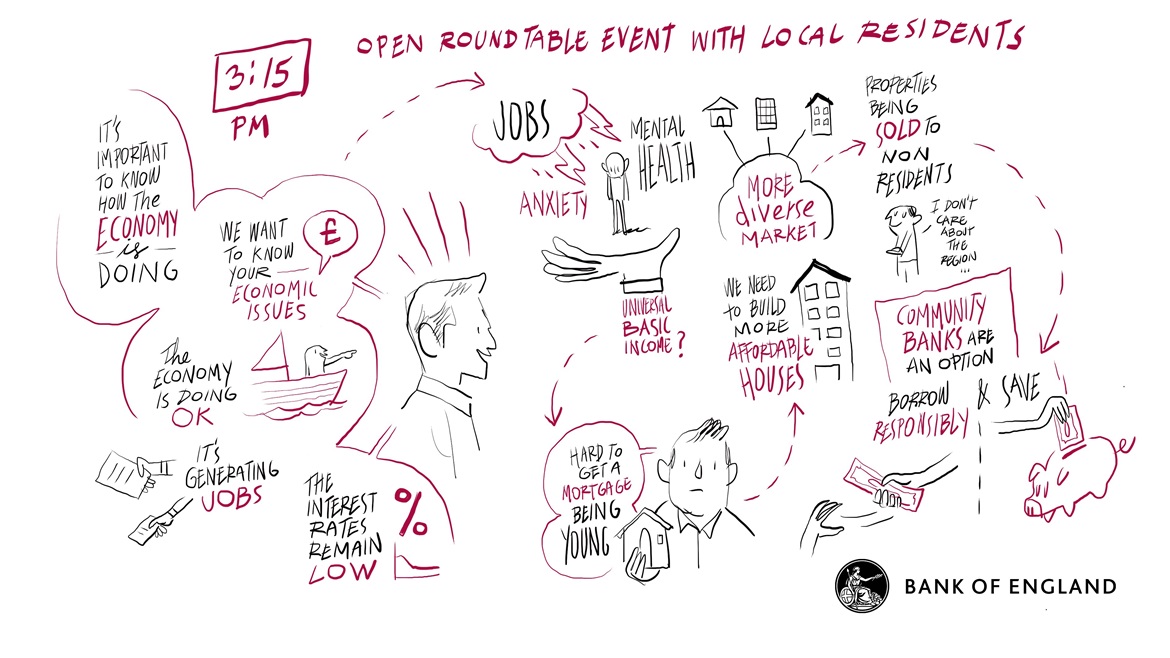

The visit came a day after the latest announcement from the Bank’s Monetary Policy Committee (MPC), on which I sit. The MPC held interest rates at 0.5%, but signalled some modest further tightening of monetary policy was likely to be needed over the next few years, to return inflation sustainably to target. The visit was an opportunity to see whether, and how, that message had landed in the North-East. By and large, I was struck by how little comment there was on the level of interest rates. I am taking no news to be good news.

Ashington, like many town and cities across the UK, has undergone a sharp adjustment over the past 40 years. Traditionally, heavy industry dominated the town, notably coal. In its heyday, Ashington was considered the world’s largest coal-mining village. No more. The last pit closed in 1986. The area’s largest employer after that, an aluminium smelter, closed in 2012. Reskilling and reemploying displaced local workers has been an on-going challenge in Ashington, a generational challenge.

Hope springs eternal. The sense of community spirit, responsibility and energy among all those I met in Ashington gives good grounds for optimism about the future. Green shoots are appearing. Ashington is home to the world’s most advanced paint manufacturing facility, located on the site of an old pit. Northumberland college has a new STEM centre, based in Ashington. And regeneration of the high street is underway, under the Chairmanship of Sir John Hall (Ashington-born and who accompanied me on the trip).

Nonetheless, it is clear there is a distance still to travel. As Ashington is not served by train, and has not been since 1964, this is as true literally as it is metaphorically. Talk of re-establishing the rail link to Newcastle – a mere 15 miles south and a wonderful example of a thriving city - has, thus far, been just that. It does not take an economist to tell you the benefits to Ashington improved transport links would bring. My hunch is those benefits, social as well as economic, would be whopper.

The lack of trains meant I arrived in Ashington, via Morpeth, by taxi. And therein lies a story. My taxi-driver was a fully-qualified music teacher who had in the past worked at the local school. He had left several years back, disaffected by his teaching experience. What a loss to the schools, their pupils and our communities examples like this are. I doubt he was an isolated one.

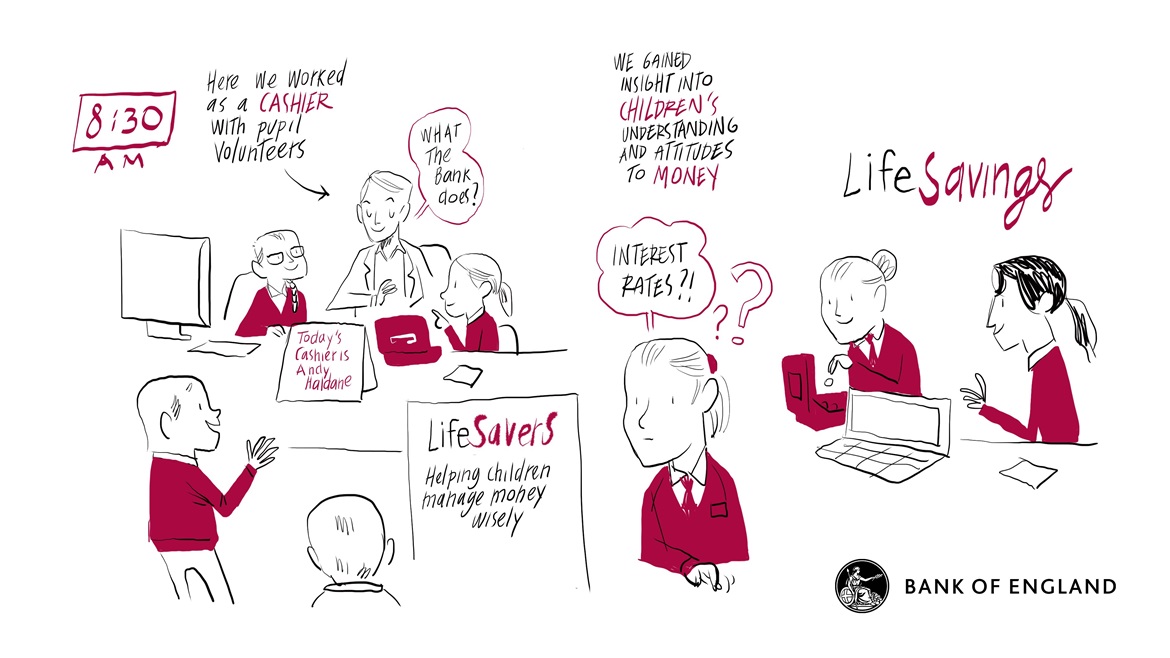

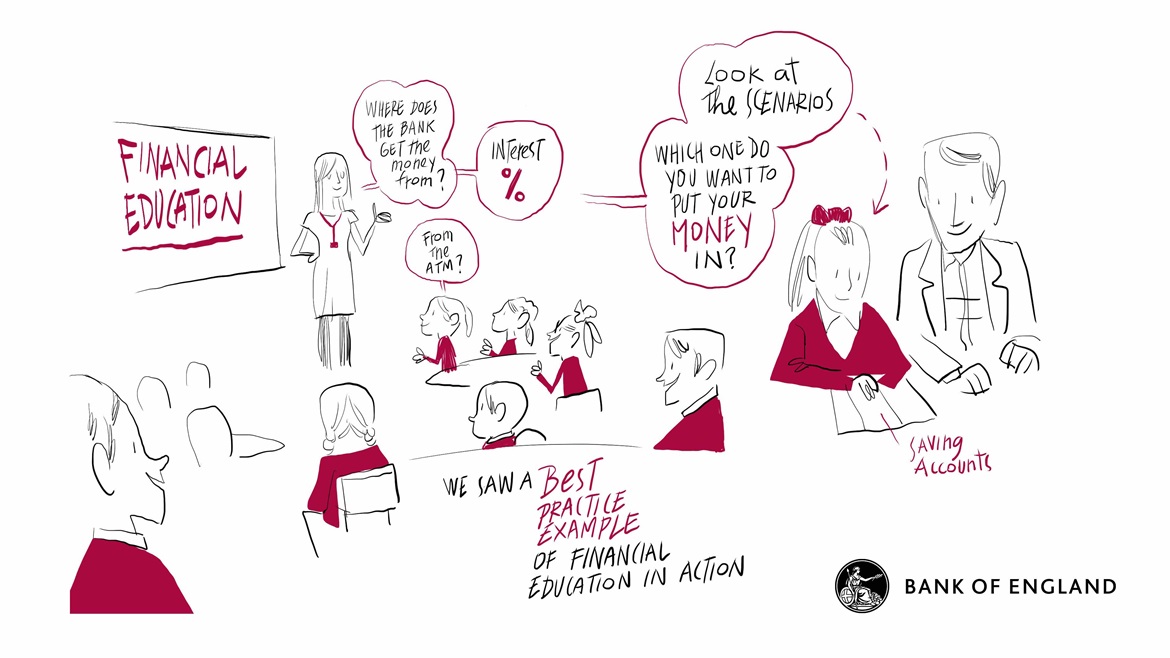

The next day I visited the same school the taxi-driver had left as a teacher. This school has come a long way since and is now an Academy. I spent time taking part in the school’s “LifeSavers” programme, a scheme designed to encourage primary school children to save and to teach them the basics of money management, embedding what is sometimes called financial literacy at an early stage. From what I could tell (speaking to pupils and teachers and working as a junior cashier), the Lifesavers programme was doing a fantastic job in supporting financial education. And it was making maths fun to boot.

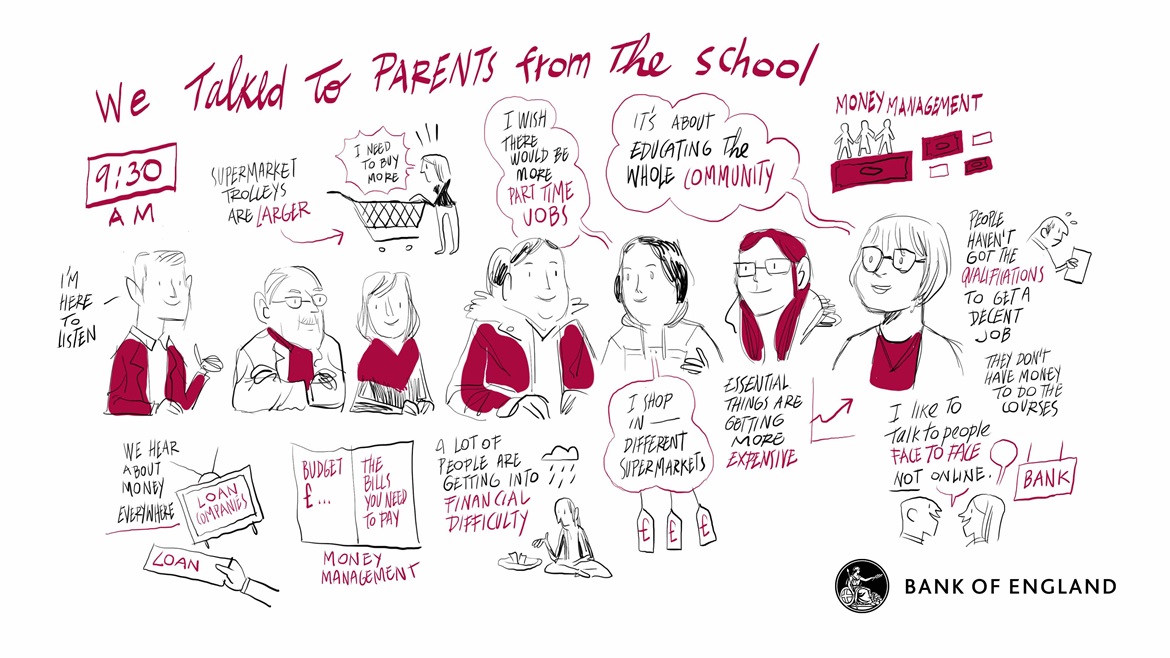

Recently, the school has begun working with some parents, as well as pupils, in talking about money matters. I spent some time with them too. This reinforced for me, as have previous Town Halls, the crucial importance of financial literacy in supporting everyday decision-making by families – where (and where not) to shop, where (and where not) and when to borrow, why and where it pays to save. My conversations with credit unions, voluntary and charitable organisations in Ashington, whose customers and clients often face acute financial stress, brought into sharp relief the costs of poor financial literacy.

The Bank is playing its part to try and improve matters. It is rolling-out in the next few months a set of educational materials for schools, targeting pupils aged 11-16 years old. This material aims to link the basics of the economy and financial system to young people’s everyday decision-making; it is called EconoME and schools can sign up here. I have in parallel written recently to the Department of Education, emphasizing the importance the Bank places on the Personal, Social, Health and Economic (PSHE) component of the curriculum, which is the part the Bank’s materials are aiming to support. Watch this space.

I would like to thank all of the participants in Ashington for their enthusiasm, passion and warmth which I know is in the bloodstream of those from the North-East. Huge thanks, too, to our partners at the Church of England and Just Finance (with particular thanks to Bishop John, Rowena, Tom, Polly, Liz and Sally) and to the Bank’s Agents in the North-East, Mauricio and Andrew.

My next stop is Preston and Blackpool next week.

Andy

Andrew G Haldane

Chief Economist