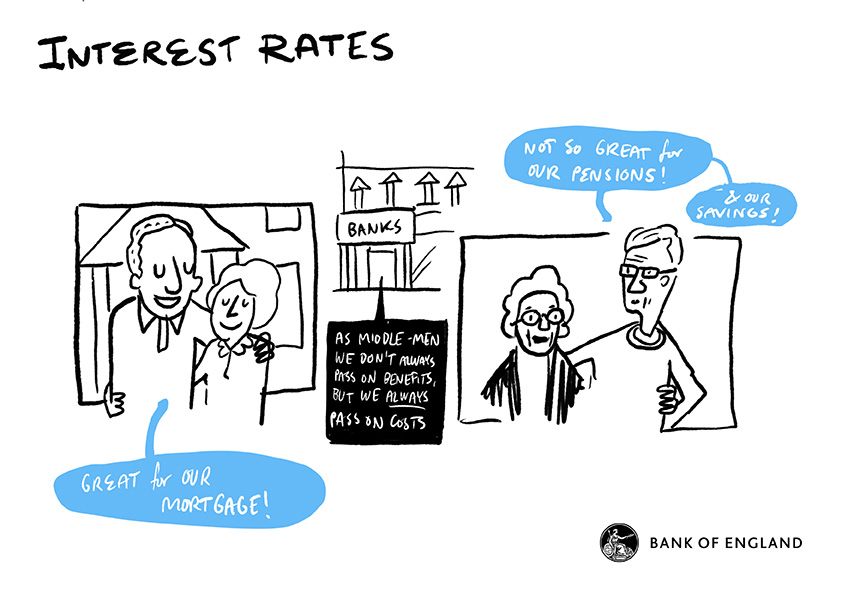

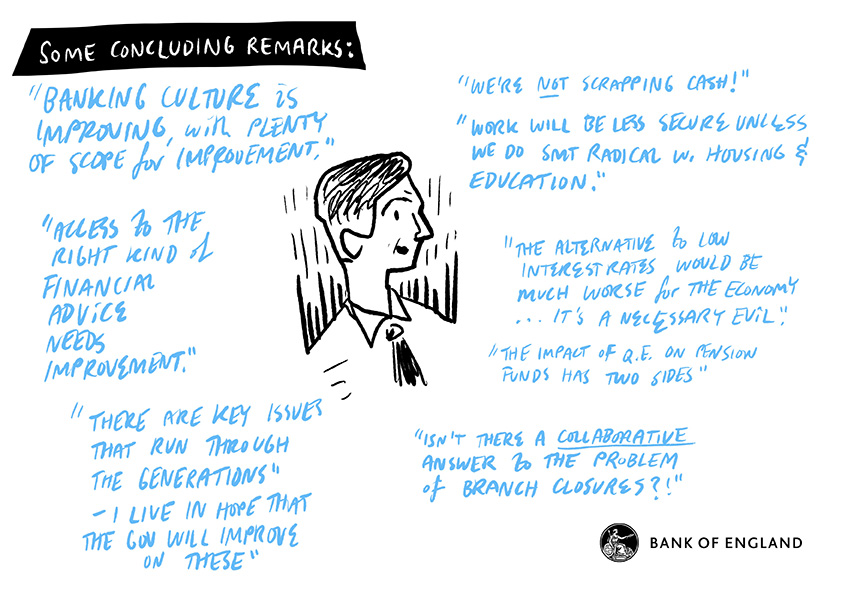

First, the effects of monetary policy on older generations. There is no question that those reliant on fixed income assets, such as deposits, have seen their savings income hit as a result of the low level of interest rates over the past decade. And I have considerable sympathy with those savers who have faced this hit to their interest income, as I told participants in the Airdrie roundtable. I would, though, make a couple of points which I think go in the other direction. The first is that those low interest rates have also supported the prices of houses, equities and bonds in the economy. This has boosted the wealth of large numbers of savers, especially older savers. A second point is that low interest rates have also done a lot to support jobs and wages since the global financial crisis, without which the economy as a whole is likely to have been a lot weaker and unemployment a lot higher.

A recent Bank of England Staff Working Paper (by Philip Bunn, Alice Pugh and Chris Yeates) has looked at these issues to gauge their effect at the household level. This included an assessment of the impact of looser monetary policy looking across the age distribution. This suggests that, while some older generations may have lost out in income terms, they have tended to gain in wealth terms. Moreover, the latter effect outweighs the former by a factor of at least 10 to 1. More generally, the set of households who, overall, have lost out financially from the period of looser UK monetary policy appears to be small. The majority have been gainers, many significantly so. I will be giving a speech on this topic myself in Melbourne next week.

Second, ageing and financial products. This is not an issue I have given much thought to previously. But several roundtable participants felt that the set of financial products currently available are not meeting the needs of an ageing population. To give one or two examples, some participants observed that the premium charged on some insurance products – and, indeed, the availability of some insurance products – was heavily age-related in a way which may not have kept pace with demographic and other trends. Another example was the availability of lending-into-retirement mortgages. Given trends in longevity, and us perhaps entering the era of the 100-year life, but also the risks that can arise with this type of lending, this is an issue where careful thinking might be needed.

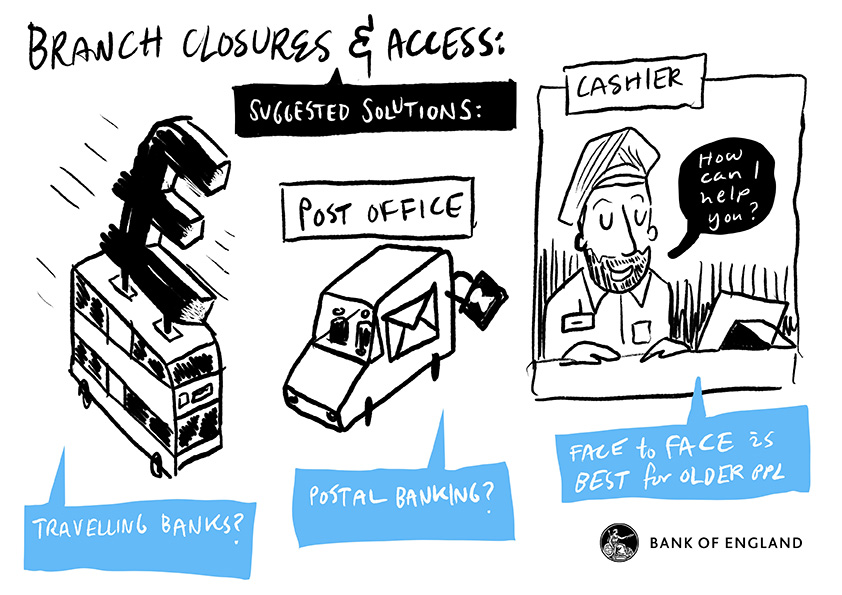

A third issue, and perhaps the most animated of them all at the roundtable, concerned bank branch closures and its impact on older generations, particularly in some of Scotland’s most remote towns and villages. Since 2010, the number of bank branches across Scotland has fallen by a third. There were a number of high-profile branch closure programmes announced last year. And more, it seems likely, lie ahead. This could leave more towns and villages without ready access to banking services, other than online. Digitalisation of banking can help reduce costs and so allow services to be provided more cheaply online. But it also brings issues for older generations who are much less likely to access online banking services or to have the digital skills necessary to do so. It was also pointed out that the value of banks to small communities is often more than just financial; they are also important socially, as part of the local community.

This issue has attracted political interest recently, with the Scottish Parliament’s Economy, Jobs and Fair Work Committee launching an inquiry in March this year. Now is not the time (and nor would it be the Bank’s place) to be entering this debate. But some of the suggestions raised by participants at the roundtable are, I think, worth recording. These included: the greater use of Post Offices to meet banking needs (although it was recognised that these too were under pressure); the greater use of mobile banks, which are already in operation in parts of Scotland; and using libraries as a means of enabling older people to learn digital skills or access online banking services.

One idea I had not come across previously, which Age Scotland have themselves put forward, is the adoption of a shared service model. This would involve the banking industry co-ordinating to provide, say, at least one branch or service-provider in a given town or region, which offered services to customers of other banks as well as their own. This would reduce the collective commercial overhead of running multiple branches, while still supporting at least one point of access to banking services for geographically remote communities. I am sure this idea would need to overcome some difficult practical hurdles. But it strikes me that this issue is unlikely to go away in Scotland or across the rest of the UK anytime soon.