Andy Haldane's Town Hall blog: Gloucestershire

On 15 May, I visited Gloucester for the latest of my Townhall visits, in an event organised in partnership with Age UK Gloucestershire. This was my second recent event with Age UK. There were, unsurprisingly, a number of similarities in many of the issues raised, so I can keep this blog short.

My visit came at the same time as a couple of significant news events which had raised issues which also cropped up during the Townhall discussion.

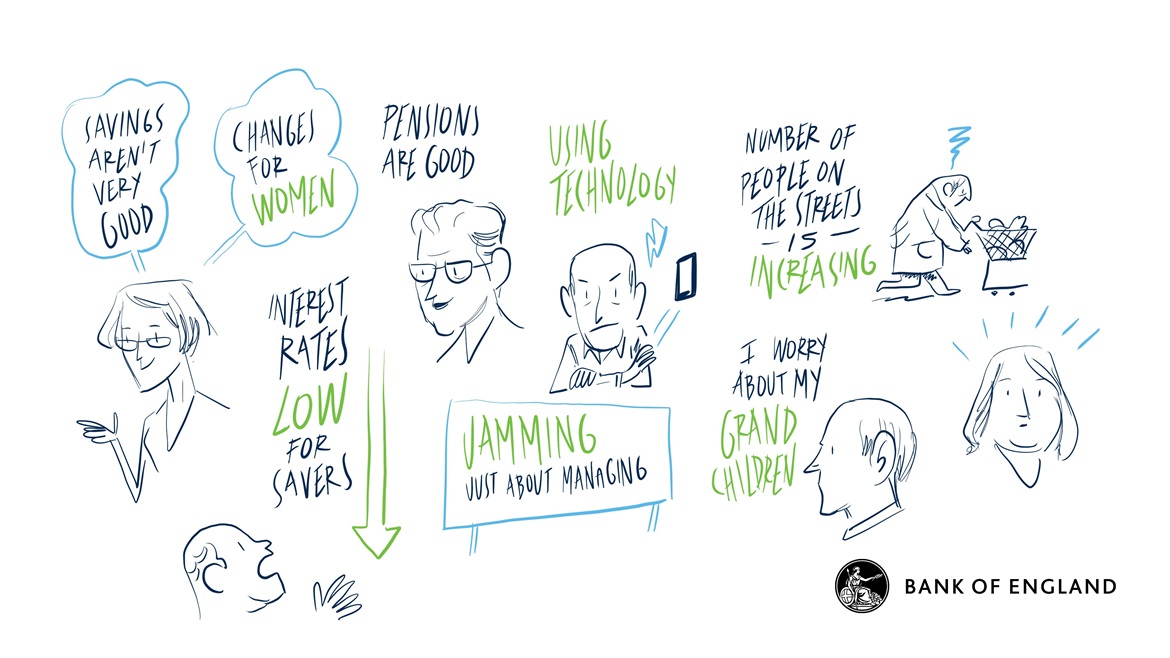

First, the Resolution Foundation published a report from its Commission on Intergenerational Inequality. This excellent report discusses a range of important issues facing people, both young and old, to ensure they are treated fairly and are able to flourish. The coverage of the report focussed largely on the important issues affecting younger generations, such as access to housing and pensions and wage and job insecurity. These are issues which have cropped up frequently at my other Townhalls. And they are clearly having an important impact on younger people’s spending and savings habits.

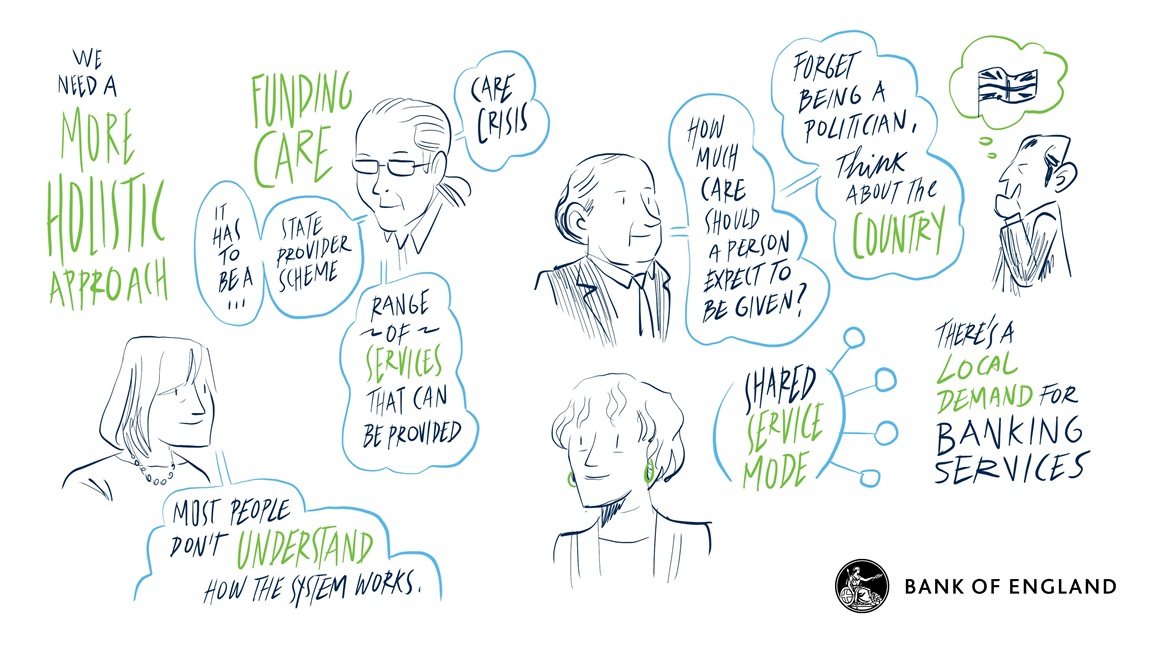

The Commission also discussed a number of issues relevant to older generations, however. One of these concerned the funding of medical and social care for those at or close to retirement. This is an issue well outside of the Bank’s sphere of influence, but was raised prominently during my Townhall discussions in Gloucester. So too was the impact of the low level of Bank Rate, both on pensioners’ savings income in retirement and on young people’s ability to accumulate savings to pay for the deposit on a house. Both of these distributional issues were discussed, and quantified, in a recent working paper by the Bank of England. They need to be weighed alongside the large and positive effects of low Bank Rate on economic activity, jobs and incomes.

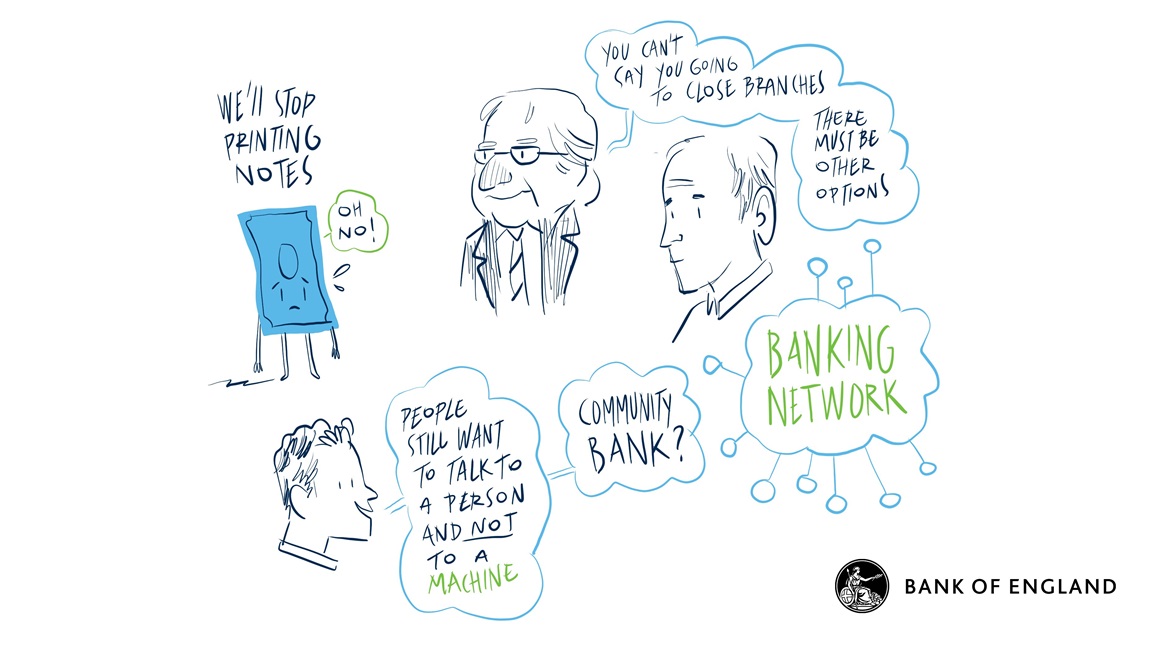

Second, there has been public concern about the well-publicised IT problems facing TSB bank. These have affected customers’ ability to access their money, quickly and easily. At the Townhall discussion the point made was that, for very different reasons, bank branch closures were having a similar effect on some older people’s ability to access their money, quickly and easily. For many in the room, this underscored the “utility-like” nature of some banking services. Not having easy access to your money could be as disruptive as not having easy access to electricity or gas services.

Pretty much everyone at the Age UK Townhall recognised that many younger people no longer visited bank branches and preferred to bank online. This trend was set to continue. Indeed, a number of those in the room had themselves made the switch online, albeit sometimes reluctantly and with difficulty. This reluctance reflected, among many, concerns about digital security – a concern that was likely to be greater if someone’s digital skills were not strong to begin with. It was also recognised that banks had put some effort into providing the help and support customers need to switch online – a good example of why financial literacy matters for all age groups in society.

At the same time, it was pointed out that there were still significant numbers of older people either unable or unwilling easily to move online to have their banking needs met. The loss of the local bank branch, for them, posed particular difficulties when gaining access to banking services. In the Gloucestershire area, this might mean travelling 10 or 20 miles to get to the nearest branch, which was often difficult or expensive (or both) using public transport. Everyone recognised there was no easy solution to this problem. Local Post Offices could, in principle, fill the gap but were themselves under threat in some villages and towns. Age UK have themselves proposed a collective or pooling model, enabling shared access to banking services from a single branch – perhaps similar to what is currently done for cash machines. The point here is that, while it may not make commercial sense for any one bank to maintain their branch, there could be a collective commercial (and indeed social) value in the banking network maintaining at least one branch, give the utility-like role banking services play.

This is an issue which may continue to rise in prominence over time. And while it is not one on which the Bank of England has a direct role, there is clearly a strong collective interest among everyone involved in the banking industry to find solutions that work for all customers.

I would like to thank Rob Fountain, Chief Executive at Age UK Gloucester and the rest of the team at Age UK for expertly organising what was a really terrific event; the participants at the event, who we worked hard for 3 hours on a hot day, and who were brim-full of candid views, ideas and good humour; and the Bank’s Agents in the South-West, Donna Kehoe and Malindi Myers.

My next visit is to Cardiff in June.