The reason money works when you pay for things is because people trust in its value. Historically, you could exchange banknotes issued by us for gold. But the link between notes and gold was broken a long time ago, so nowadays it makes more sense to think of money as a kind of IOU (I owe you).

To understand how money works, a good place to start is to think of a world without money.

In such a world, people could barter with one another: a fisherman could trade some of his catch for fruit grown by a farmer, say. Of course, this wouldn’t always be very convenient. For one thing, you wouldn’t always want to exchange goods at the same time as the person you’re trading with.

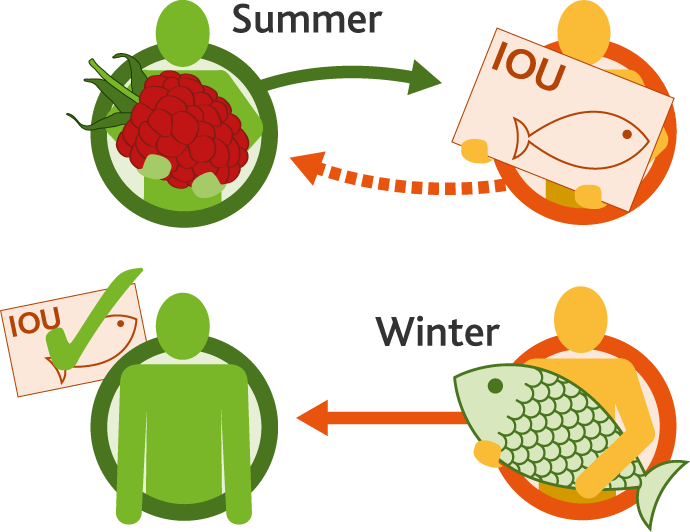

Using IOU notes could help with this. In the summer, when the farmer gives the fisherman berries, the fisherman could write the farmer an IOU. Later in the year, the fisherman could fulfil his promise by delivering some fish to the farmer.

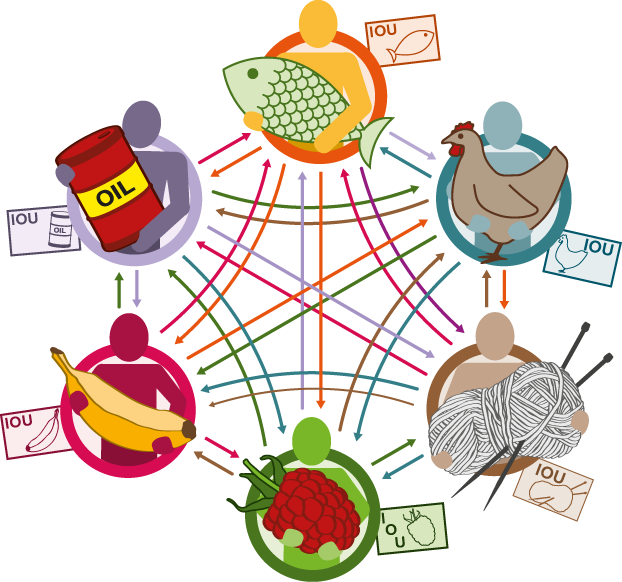

While this could work on a small scale, in modern society people buy a huge range of different goods and services. If everyone relied on IOUs, it would soon become a very complex system. Because of the chains of IOUs involved, you might end up having to trust people you had never met before. Plus you’d need to trust that all the IOU notes you were receiving were genuine.

Simple example of exchange using IOUs

Complex web of IOUs

How does money make it easier to buy and sell things?

Because of these complications, using money is an easier and safer system for all involved. You can think of money as a special type of IOU: one that’s accepted by everyone.

When money is issued by a central bank, people are able to trust the value of the notes as they are all coming from a single, trusted source.

We have been issuing banknotes for over 300 years. It’s our job to make sure that when you spend a banknote, the person who receives it can trust in its value – that they too will be able to exchange it for the same value of goods or services.

An important part of our work is therefore to make sure that the banknotes we all use have state-of-the-art security features, since if counterfeit banknotes are mistaken for genuine ones, this would erode people’s trust in their value.

Bank of England's explainer on why banknotes have value.

-

Hi, my name is Dan and I work at the Bank of England. Today, I’m going to tell you about the value of banknotes. In 1694 when the Bank opened, it took deposits of gold coin from its customers. It issued paper receipts or notes in return. These were used as convenient ways to pay for things, rather than using gold. People accepted these notes as a promise to pay, knowing they could take them back to the bank at any time in return for gold.

These receipts gave rise to the banknotes we recognise today. But it’s no longer possible to pay in gold. So what gives modern banknotes their face value? Trust! We trust in the promise that our banknotes can be exchanged for the things we want and that they will be accepted for their face value. Public trust in banknotes is based on the security features that make them difficult to forge and the low inflation that protects their value over time.

What else affects how much my money is worth?

For a £10 note to be worth £10, people need to trust that the note is genuine. But how much you can buy with it also matters. This is why price stability is important. For instance, if prices go up drastically in a short time, you can’t buy as much with your money – and it becomes difficult to predict how much your money is worth. In really extreme cases of ‘hyperinflation’, prices have gone up by many times each day. This happened in Zimbabwe in the 2000s and resulted in people simply refusing to use Zimbabwean banknotes.

We have a responsibility to make sure that the value of your money stays broadly stable.