Financial Stability Paper No. 42

By Yuliya Baranova, Jamie Coen, Pippa Lowe, Joseph Noss and Laura Silvestri

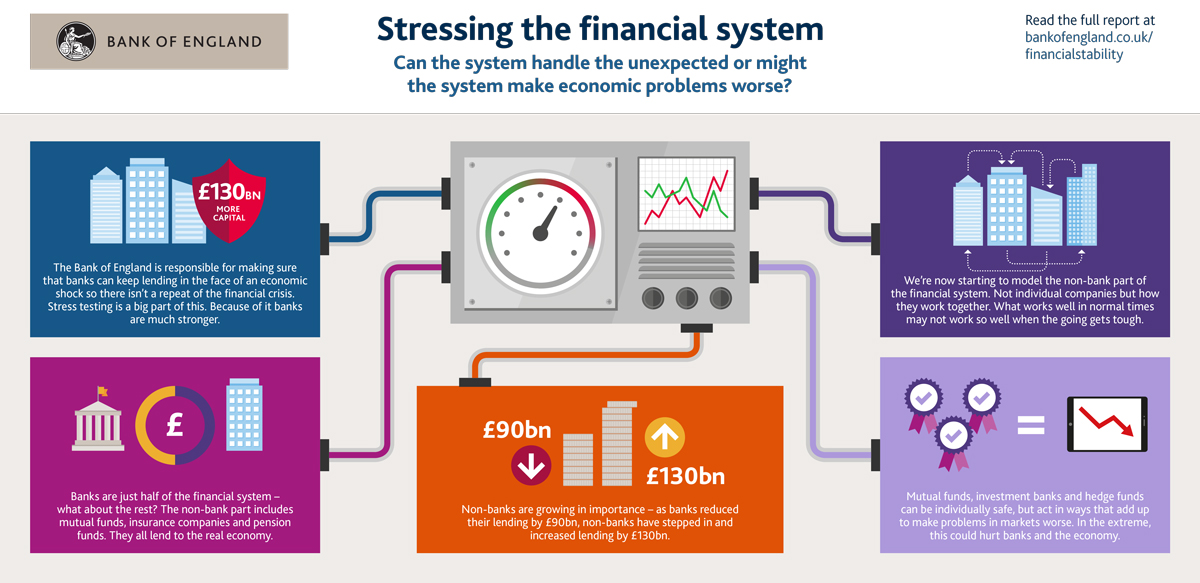

This paper provides a first step in developing a system-wide stress simulation. The model incorporates several important features of the financial system. These include several types of institution (including banks and non-banks) and how their actions may propagate and amplify stress. Rather than attempting to predict outcomes of a given stress scenario for financial sector balance sheets, it seeks to explore those conditions under which systemic stress may crystallise.