Why are we consulting?

The derivatives data reported under Article 9 of the UK European Market Infrastructure Regulation (UK EMIR) provides transparency to us and the Financial Conduct Authority (FCA) of the UK derivatives market for systemic risk and financial stability monitoring purposes. It is important the data to which we have access is complete, accurate, reported consistently and on time to ensure we can fulfil our financial stability objectives and to promote the safety and soundness of regulated firms.

We are consulting jointly with the FCA on guidance to support implementation of the amended UK EMIR reporting requirements that will go-live on 30 September 2024. The draft guidance is in the form of Questions and Answers (Q&As), grouped into relevant topics.

Draft Q&As

The draft Q&As we are consulting on have been informed by discussions with trade associations, reporting counterparties, trade repositories (TRs) and central counterparties (CCPs) via the UK EMIR Reporting Industry Engagement Group. This group, co-chaired by us and the FCA, provides a forum for discussing UK EMIR reporting issues with industry to ensure consistent reporting.

In developing these Q&As, the Bank of England (the Bank) has considered its objective to protect and enhance the financial stability of the UK, its secondary objective to facilitate innovation and other statutory obligations.

The Q&As will be divided up into the following topics. In this first consultation, we are covering topics 1 to 5:

1. Transitional Arrangements

2. Reconciliations

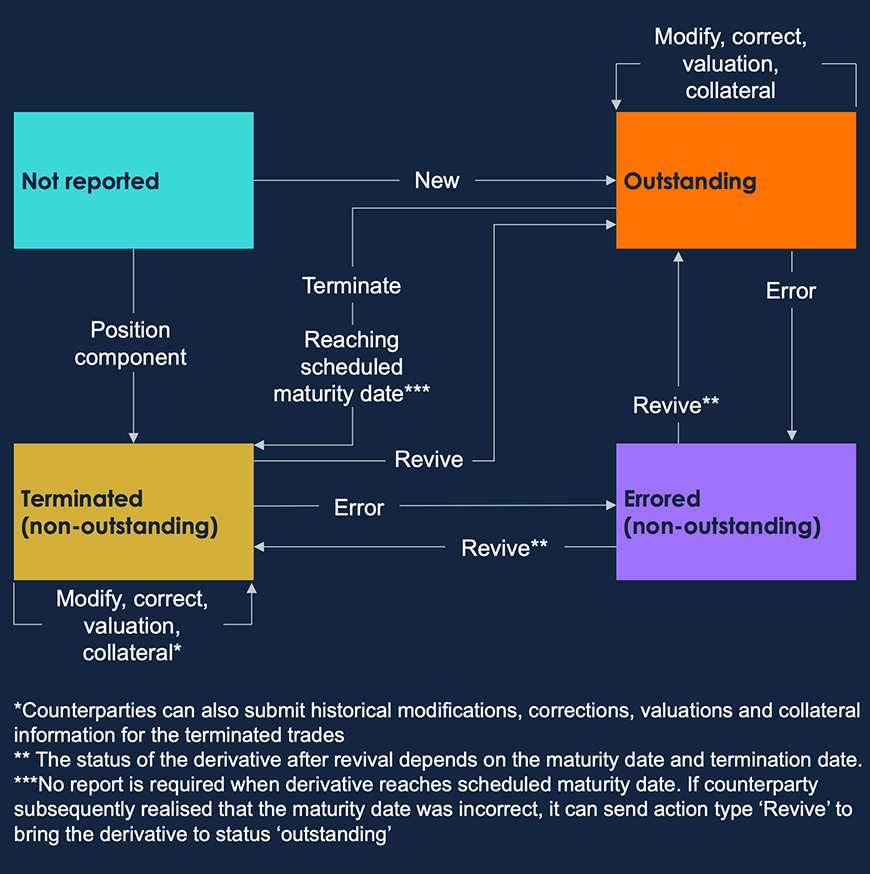

3. Errors and Omissions

4. Derivative Identifiers

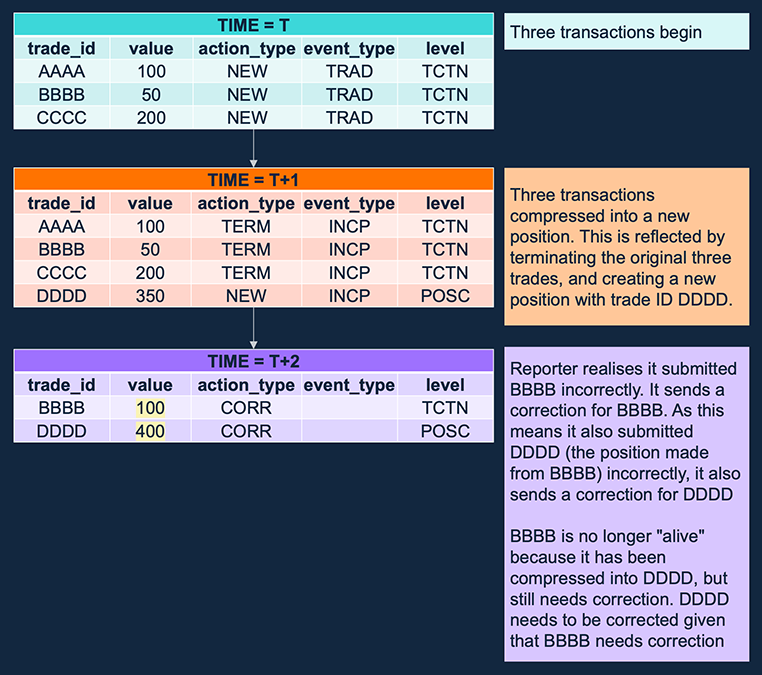

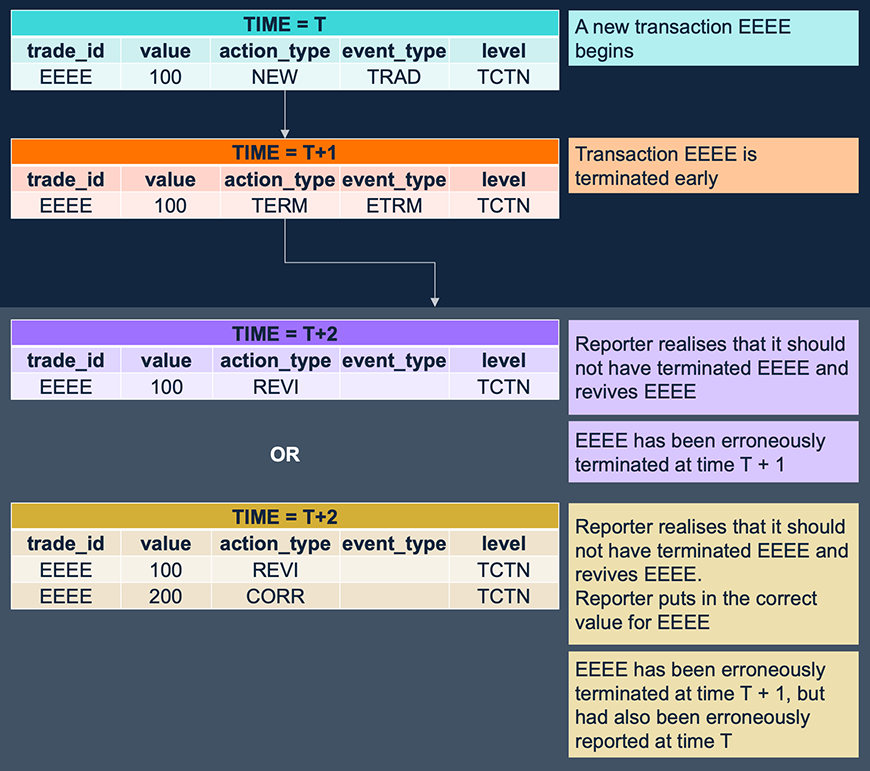

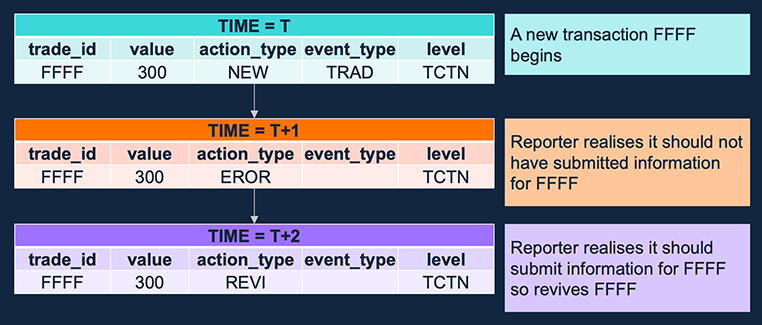

5. Action and Events

6. Venues

7. Exchange Traded Derivatives

8. Margin and Collateral

9. Clearing

10. Position Level Reporting

11. Asset Class and Product Specific

In certain circumstances, the draft Q&As also require a corresponding change to the UK EMIR Validation Rules (applicable from 30 September 2024). As a result, we are also consulting on those changes, and we indicate within the relevant Q&A where a such a change is proposed. We do not generally consult on Validation Rules. On this occasion however, and on an exceptional basis, we invite participants to provide any feedback.

Consultation outcome

This first consultation closed on 28 March 2024.

We received nine responses from a range of participants including TRs, trade associations, reporters and consultants. The overall feedback was supportive of our approach and the proposed guidance. Given the supportive feedback, we have retained the overall approach consulted on.

Some respondents requested further clarification, highlighted incorrect references, or further changes to the Validation Rules as a consequence of the proposed guidance. These have been reflected in the final Q&As, specifically questions 1.3, 1.4, 3.1, 4.1, 4.4 and 5.3. An additional clarification to the initial description in Section 1 has been made and a proposed change to the UK EMIR Validation Rules (applicable from 30 September 2024).

A number of the respondents were concerned about the proportionality of completing reconciliation checks during the 6-month transition period (particularly where reporting counterparties comply with the new requirements at different times). This is something we had acknowledged in the draft guidance, but we continue to believe the benefit of identifying and resolving ‘true’ reconciliation breaks early, as opposed to only from the end of the transition period, will be enhanced data quality.

We also received some feedback beyond the scope of the consultation. We have not addressed this feedback here, but we may consider it in future.

We have therefore finalised this first part of the UK EMIR Reporting Q&As (applicable from 30 September 2024), as it supports the Bank’s financial stability objective. The draft text below is retained here for transparency.

Our second consultation on the UK EMIR Reporting Q&As closed on 12 June 2024. We are now reviewing and considering the feedback received.