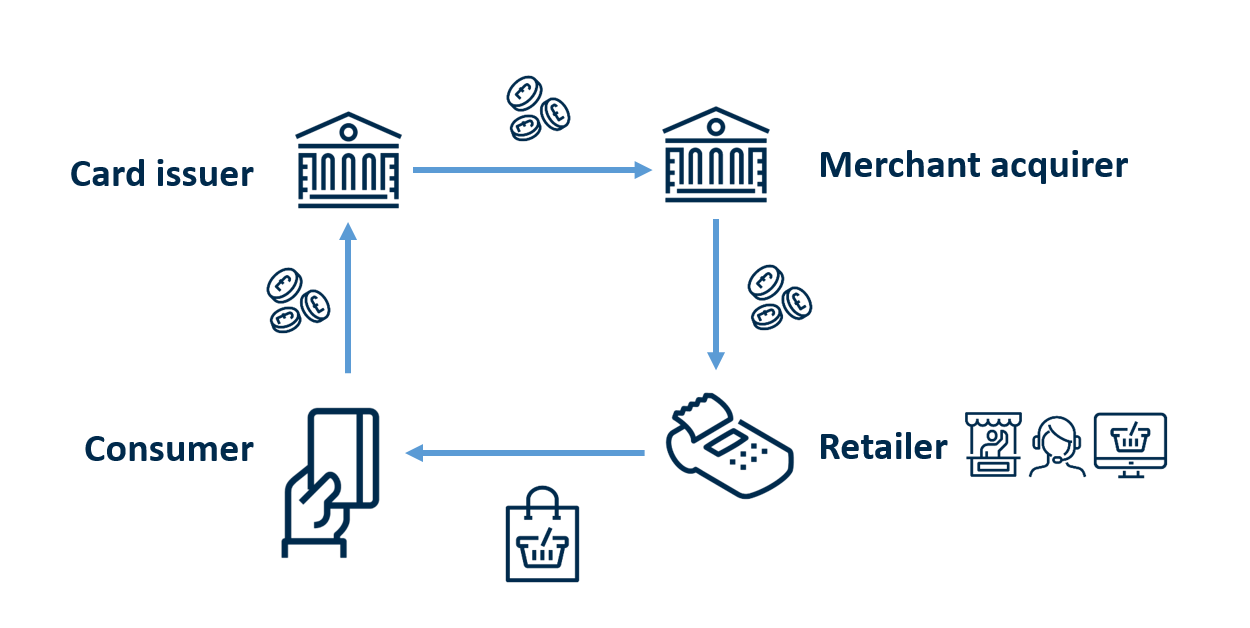

When merchant acquirers pay retailers and other types of card accepters the proceeds from card transactions made at their stores (including telephone/online platforms), they will typically make a single bulk payment each working day. Each payment is typically for the sum of card transactions processed the previous working day (plus any weekends or bank holidays since then). Therefore, the payment made by the merchant acquirer on a Friday typically reflects Thursday’s card transactions, and on a Monday generally reflects Friday to Sunday’s card transactions.

For the largest firms, this bulk payment can be for millions or tens of millions of pounds. Where the merchant acquirer and the card accepter use different banks (or payment service providers), these bulk payments will often be made via CHAPS, the sterling high value payments system operated by the Bank of England. The Bank has access to CHAPS transactional data as the operator of RTGS and CHAPS.

Methodology

In May 2024, the Bank suspended the production and publication of the original debit and card spending index after identifying unexpected volatility.

Following a comprehensive review to ensure the index remains relevant and enhance the methodology behind it, publication of a revised index started in November 2024. Due to the changes made, the values in the revised series are not directly comparable to the original series. The methodology for the revised series is described below.

The Bank has identified regular CHAPS payments from merchant acquirers to around 1300 companies within its transactional data. These payments are sampled and aggregated into an index representing a percentage change in the weekly credit and debit card revenue of companies relative to the average value of payments for June to December 2023.

To be included in the sample, companies must have a relationship with one or more of the main merchant acquirers and meet certain payment frequency conditions, and therefore include a sample of all card accepters in the economy. This approach requires that a company is transacting at least once in each given week and at least once the week before. This adds stability to the sample by excluding one-off transactions from companies that do not contribute regularly to the UK economy but can lead to noise in the data. The data exclude non-UK transfers, personal transactions, or transfers between merchant acquirer’s own business accounts to the extent possible. Finally, a small number of merchants/companies that exhibit significant volatility in values are removed from the sample. After applying these rules, we arrived at around 1300 merchants/companies.

Changes in the index reflect changes in the level of purchases made at the companies, and the sample composition in any given week, given how many companies meet the payment frequency requirements in that week. There is no backwards revision to the data to account for companies joining or leaving the sample.

Each data series is indexed to a start date of average purchases in that consumption category in February 2020 (= 100) i.e. prior to the first lockdown restrictions in the UK. The figure for any particular day represents a backwards-looking seven day rolling average (reflecting that these payment flows are volatile on a day-to-day basis, but follow regular weekly patterns).

Benefits and limitations of the series

The key benefit of the series is that it can provide a near-real time tracker of credit and debit card expenditure, which changes in response to market fluctuations.

The series does, however, have a number of limitations.

- There is no adjustment for the longer-term effect of card payments representing an increasing share of all payment methods. As such the series is better suited to observing short-term changes rather than long-term trends.

- The series only identifies a subset of UK companies that accept cards; around 1300 in total. As a CHAPS-based series, it can only ever cover the subset of companies whose merchant acquirers use a different payment service provider (PSP) (such as a bank) to themselves. Where the company and merchant acquirer use the same PSP the transfer may be internalised within the PSP’s own books with no payment made to the company across the CHAPS system. This may include where the PSP itself provides merchant acquiring services directly to the company as part of a package of banking services,

- Merchant acquirers may change how they pay companies the proceeds of card purchases: for example, Faster Payments or Bacs. As such, the companies that receive CHAPS payments from merchant acquirers may change regularly.

- The model uses ISO 20022 CHAPS payments. The ISO 20022 payment messaging standard offers many benefits, including enriched and more structured data, on which the series relies. This data is only available from June 2023, and so we are only able to produce this series back to that point.

The Bank is unable to provide a sectoral breakdown of the data as the structure of the payments data makes it impractical to classify companies within the time constraints for producing a real-time indicator. We are similarly unable to split the results by category of spend as corporates may provide services across multiple categories. This differs from the original series.

Other similar series available

Several other organisations provide indicators of UK spending on credit and debit cards using data from transactions across their systems, for example Barclaycard and Visa. These other data sets may be based on a more comprehensive data set than the Bank’s and may incorporate adjustments to reflect longer term structural changes. The richer data set means that those series may be more reliable indicators of purchasing activity, both in the short term and especially in the longer term. However, the Bank can make its series available via the public ONS real-time indicators weekly release.

Please be aware that both the Bank’s Monetary Policy Committee (MPC) and Financial Policy Committee (FPC) have access to a variety of similar indicators and data sources. Thus, this real-time data series should only be considered indicative of the broader set of UK card purchasing data available to the MPC and FPC.