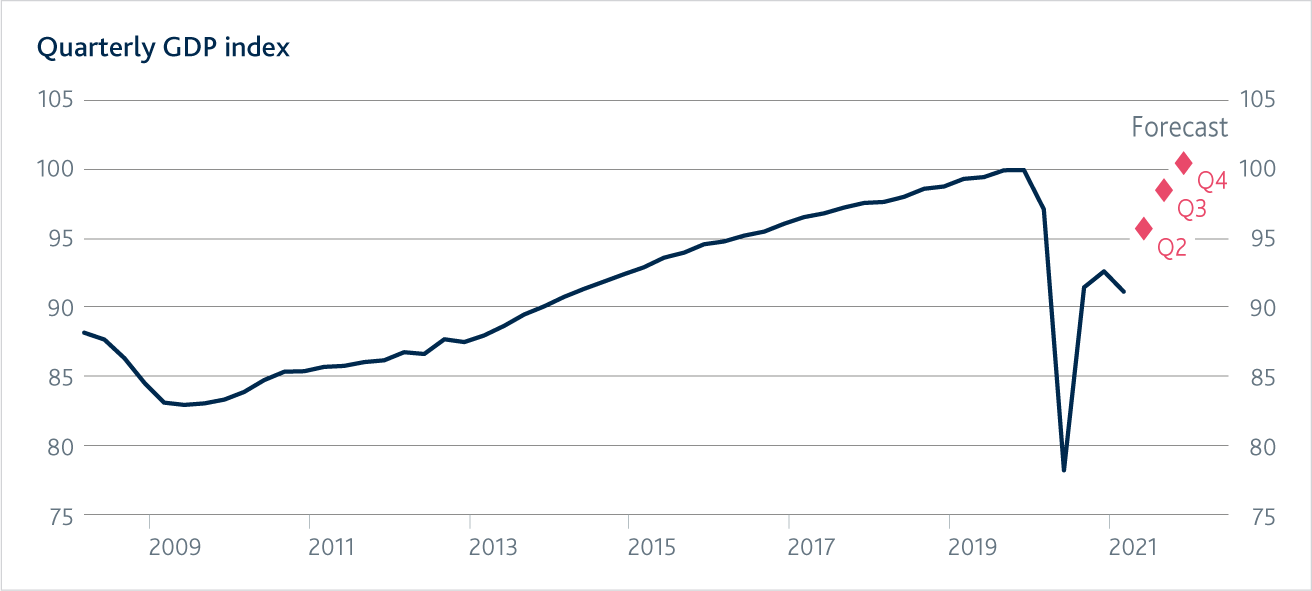

Vaccines are helping spending, jobs and incomes recover from the effects of Covid. The size of the UK economy is getting close to where it was before the pandemic. Unemployment is falling, although the number of people in work is lower than it was before the pandemic.

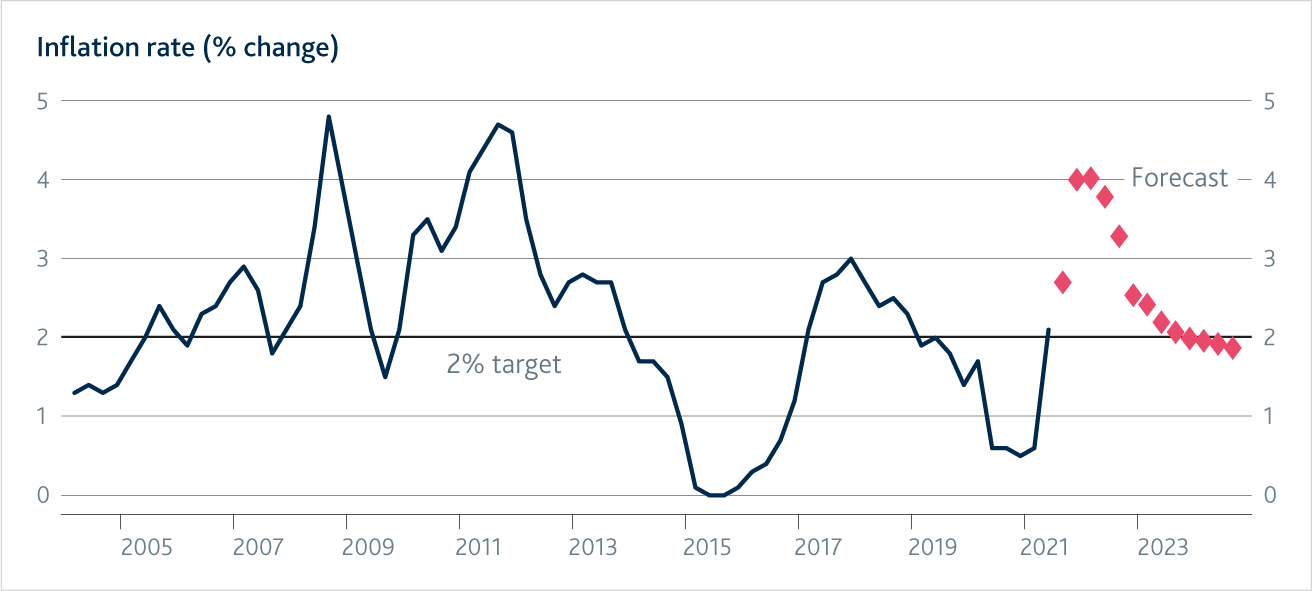

(the pace of price rises) has risen above our 2% target. Prices rose by 2.5% between June last year, when prices were low because of Covid, and June this year.

We expect inflation to rise further in the coming months. As countries around the world have reopened, demand for some goods and services increased sharply. Some businesses have struggled to meet this extra demand, because of things like shortages of materials used in production. That pushes up costs and prices.

We expect above-target inflation to be temporary. We don’t think that demand will continue to rise as fast, and some of the shortages that are currently making it difficult for businesses to produce their products should ease. We expect inflation to fall back, reaching our target in around two years’ time.

Our job is to ensure that inflation returns to our target sustainably. In response to the Covid pandemic, we have been supporting households and businesses through low and quantitative easing. This keeps the cost of borrowing low.

To support the recovery and ensure that inflation stays close to our 2% target in the medium term we have kept our interest rate at 0.1%, and the amount of quantitative easing at £895 billion.

Vaccines are helping spending, jobs and incomes recover

As more people have been vaccinated, restrictions to control the spread of the virus have been lifted in a number of countries around the world.

In the UK, spending by households and businesses has been rising.

The Government’s furlough scheme has helped many people stay in their jobs, although the number of people in work is lower than it was before the pandemic.

We expect the recovery to continue, as people become more confident about spending.

Inflation is above our 2% target. We expect it to rise further in the coming months, and then fall back to our target

On average, the prices of the things people typically buy increased by 2.5% between June last year, when prices were low because of Covid, and June this year.

This means inflation is above our 2% target.

We expect inflation to rise further in the coming months.

As Covid restrictions have been eased in many countries around the world, there has been a big increase in demand for certain products.

Some businesses have struggled to meet this extra demand, because of difficulties in getting the materials used in production, for example. This is pushing up costs and prices.

We don’t think that demand will continue to rise as fast, and we expect some of the difficulties businesses are facing in producing their products to ease.

We expect inflation to fall back, reaching our target in around two years’ time.

We will set interest rates to support households and businesses and ensure inflation returns to target

In response to the Covid pandemic, we have taken prompt and substantial action to help households and businesses and meet our inflation target.

First, we cut interest rates to 0.1% in March 2020 and kept them there.

Second, we are letting UK banks and building societies borrow money cheaply from us so they can keep the rates they charge their customers low.

Third, we are supporting the UK economy through quantitative easing. This mainly involves us buying government bonds. This helps to keep the interest rates on mortgages and business loans in the UK low.

Lower interest rates mean cheaper loans for households and businesses. That reduces the costs they face, and encourages companies to employ people and invest.

We will keep doing all we can to help UK households and businesses. We will do this by ensuring that inflation returns to target which supports jobs and growth.