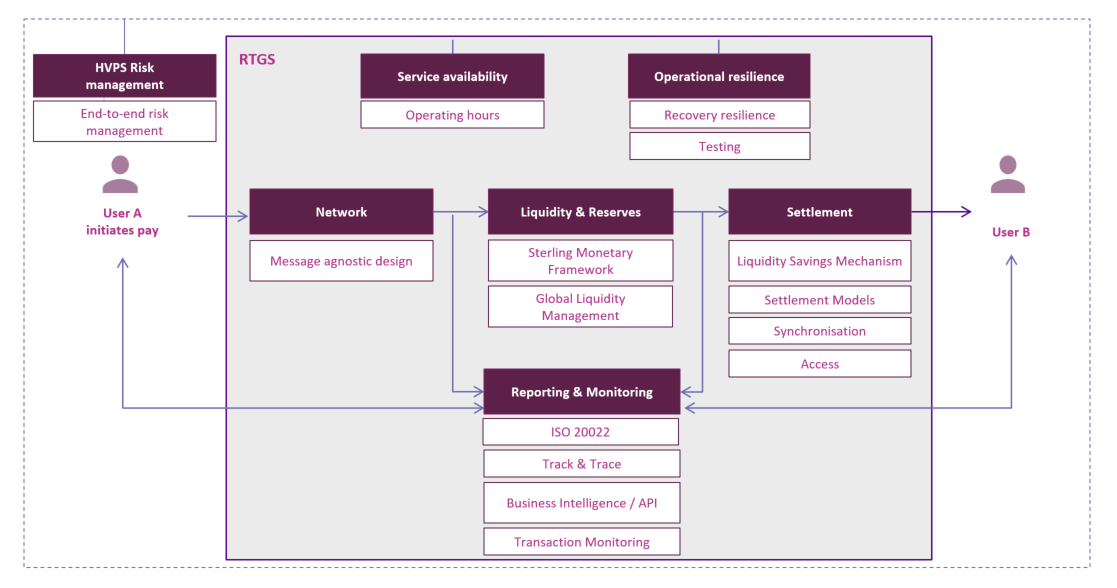

7. Reporting and monitoring

7.1 ISO 20022

We will adopt ISO 20022 messaging standards for High Value Payments System (HVPS) payments across the renewed RTGS service. Development of the message set for the UK HVPS will, as far as possible, be in line with the HVPS+ framework, UK retail payment schemes, and HVPS in other jurisdictions to ensure international harmonisation and domestic interoperability. The renewed RTGS will ensure ISO 20022 goes beyond the current message standard by introducing additional information fields and adding structure to existing fields. More information can be found on the ISO 20022 page.

7.2 Track and trace

The new RTGS service will support the SWIFT GPI (Global Payments Innovation) service, to allow track and trace of payments for CHAPS members. SWIFT GPI is able to support domestic and international payments. We will not be developing our own track and trace functionality.

7.3 Business Intelligence APIs

We will develop automated real-time tools for accessing RTGS transactional and liquidity data. There will also be some write access APIs, subject to the ability to secure it adequately. The Bank will continue to provide data via a user interface.

For more information, please refer to our Latest thinking on using Application Programming Interfaces (APIs) to enhance how users interact with the renewed Real-Time Gross Settlement (RTGS) Service (pdf).

7.4 Transaction monitoring

The new service will be able to deliver data to users on all aspects of the payment messages ex-post and in a timely manner. This will allow users to enhance their own compliance monitoring. The data could be delivered to a potential future central utility tasked with monitoring. There will be no ex-ante transaction monitoring in the renewed RTGS.