ISO 20022: the new messaging standard for CHAPS and RTGS

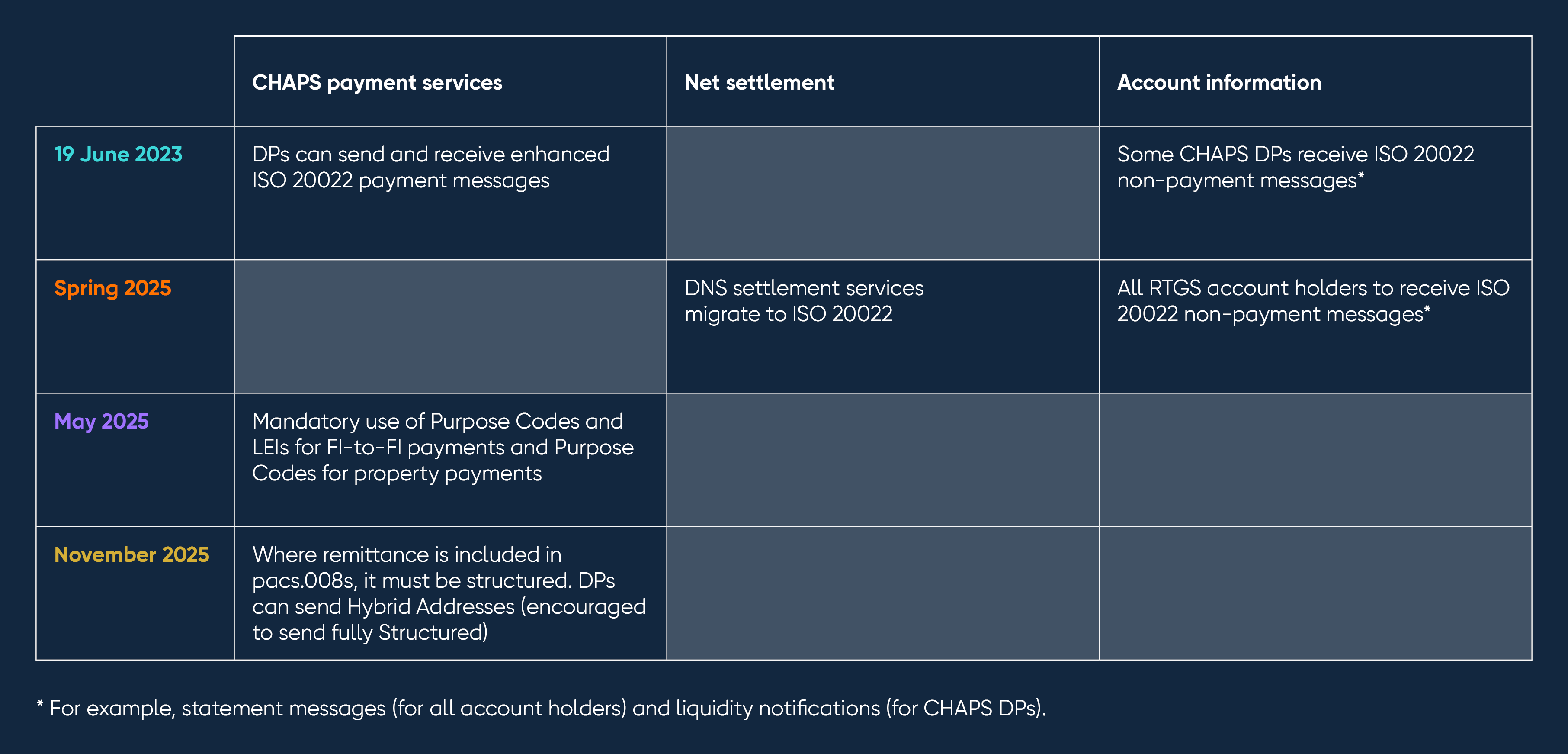

On 19 June 2023, CHAPS and the Bank’s Real Time Gross Settlement System (RTGS) migrated to the ISO 20022 messaging standard. The ISO 20022 message standard facilitates the sending of enhanced data in a richer, more structured format than currently, which will bring a wide range of benefits. It is an open international standard, which has the potential to create a single common language for most payments globally. In addition to the UK, many major jurisdictions are also implementing ISO 20022 ahead of November 2025, when SWIFT is scheduled to retire its existing MT message standard for payments.

On this page you will find all the information on our migration and policy approach, timelines, and stakeholder requirements. You should continue reading if you fall into one of the following categories:

- CHAPS Direct Participants and their customers, or indirect participants.

- RTGS account holders.

- Users who make, receive or process CHAPS payments.

- Technology vendors who develop and provide payment related solutions.

- Other stakeholders with an interest in the future of UK payments.

The Bank and Pay.UK have established the Standards Advisory Panel, which provides industry advice on the adoption of new payment standards in the UK. Please see our Industry Engagement page for further details and past minutes. You can also find out about how we are collaborating with Pay.UK and the industry on ISO 20022 payment messages.