5. Enhanced data policy and guidance

The Policy Statement: Mandating ISO 20022 Enhanced Data in CHAPS sets out the Bank’s policy position for the implementation of enhanced data in CHAPS through the ISO 20022 messaging standard. It also consults on how we intend certain policies around enhanced data to expand from 2027.

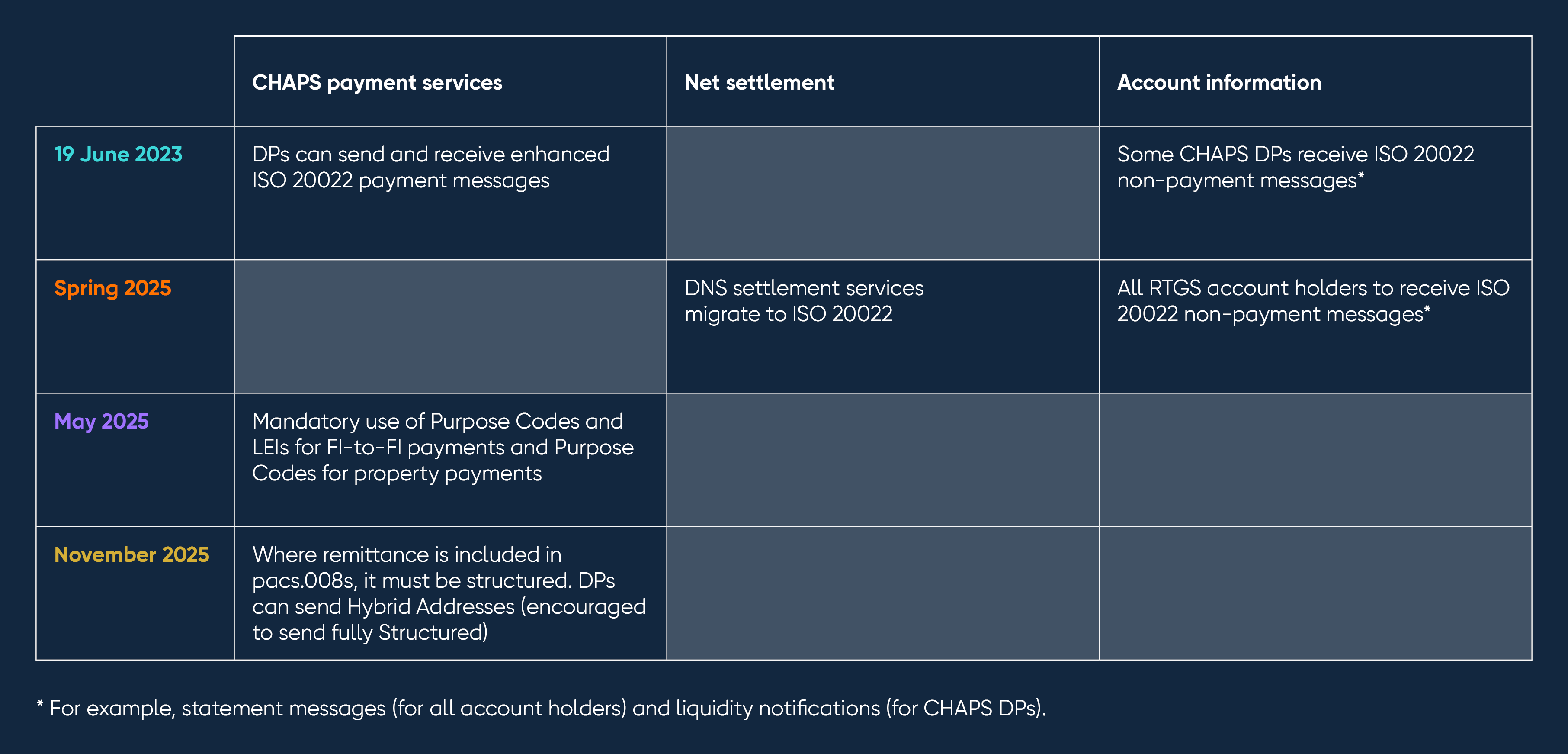

The Bank supports enhanced data and strongly encourages each Direct Participant to use enhanced data once they are capable of sending. From May 2025, we will mandate the use of Purpose Codes and LEIs for CHAPS payments between financial institutions, and mandate the use of Purpose Codes for property transactions. For further information on Purpose Codes please see the UK recommended Purpose Code list and Consultation response on Purpose Codes in ISO 20022 Payment Messaging. When SWIFT retires MT messaging for payments (currently expected in November 2025), we will mandate the use of structured remittance for pacs.008 payments. In line with international standards, we will enable hybrid addresses from November 2025, and reject fully unstructured addresses from November 2026.

We have continued our close collaboration with Pay.UK on implementing ISO 20022 messaging standards to ensure interoperability between CHAPS and the retail payment systems operated by Pay.UK where appropriate. In particular, to facilitate the introduction of Purpose Codes, the Bank and Pay.UK have jointly developed a UK recommended list of Purpose Codes.

For more detail on the Bank's updated policy timelines on enhanced data, please see our Policy Statement: Mandating ISO 20022 Enhanced data in CHAPS.

Market Guidance

The Bank’s approach to working with industry to develop ISO 20022 Market Guidance was outlined in our Policy Statement: Implementing ISO 20022 Enhanced data in CHAPS.

These guidance documents have been commissioned independently on behalf of the Bank, based on engagement with industry. The Bank will continue working with industry stakeholders to define market best practice guidance for implementing the ISO 20022 messaging standard in order to realise the benefits of enhanced data, including through our Enhanced Data Working Group for CHAPS Direct Participants.

Note these Market Guidance publications are static documents so please check dates with this ISO 20022 Handbook.