By Kushal Balluck, Artus Galiay, Gerardo Ferrara and Glenn Hoggarth

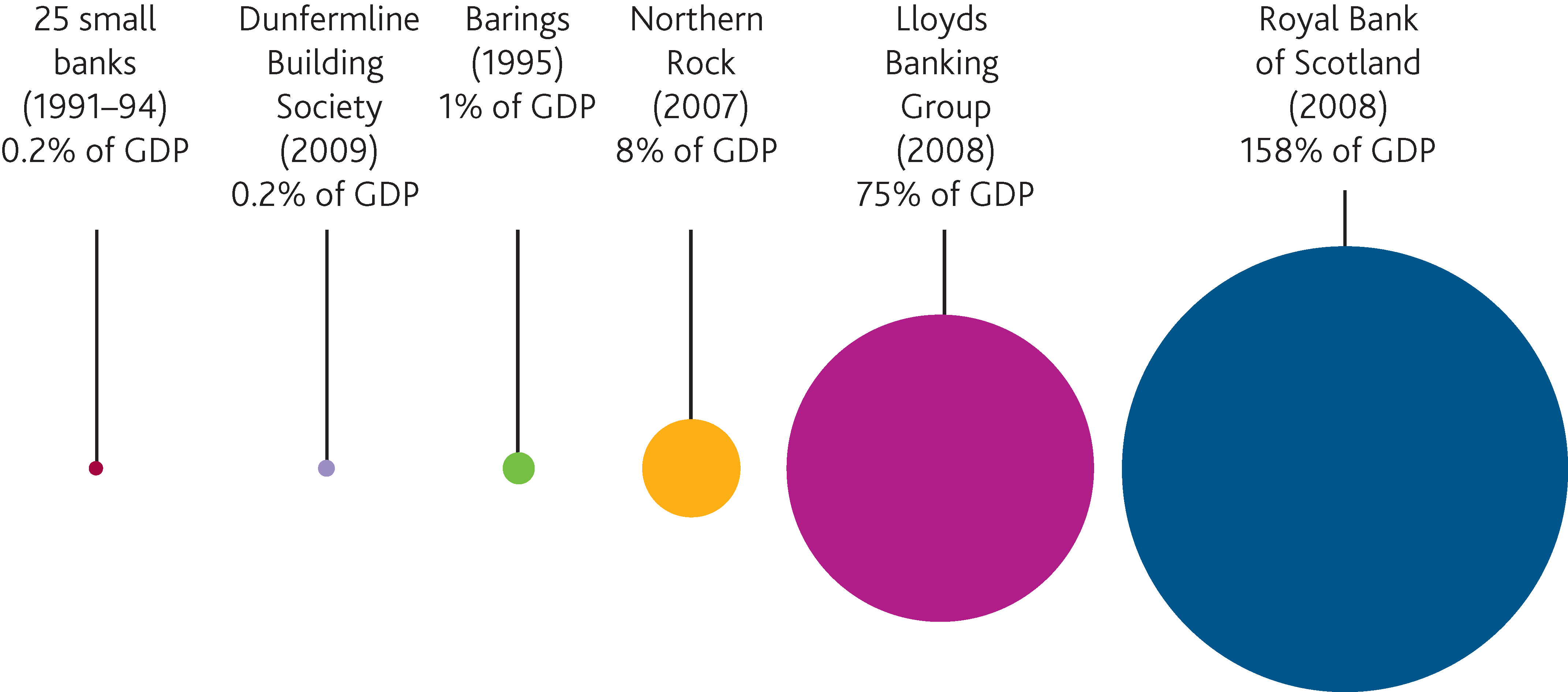

Prior to the recent global financial crisis, the Bank of England last provided emergency liquidity assistance to banks in the early 1990s. This was intended to prevent contagion from a group of small banks to larger, systemically important financial institutions. The Bank of England is now in a better position to guard against many of the vulnerabilities that led to the small banks crisis. History suggests that regulators should continually look for early warning signs of heightened risk in the financial system, such as rapid credit growth, a decline in underwriting standards and large shifts in business models.