Fernando Eguren Martin, Mayukh Mukhopadhyay and Carlos van Hombeeck of the Bank’s Global Spillovers and Interconnections Division.

The US dollar is widely used in international trade and finance. It is the currency of choice for cross-border bank lending and international debt issuance, particularly for emerging market firms. It is also the dominant invoicing currency for trade transactions between non-US countries. Its global acceptance means that it has achieved ‘reserve currency’ status, which means that it is widely used as a store of wealth, accounting for more than half of the foreign exchange reserves of central banks and about half of the external assets of non-US countries.

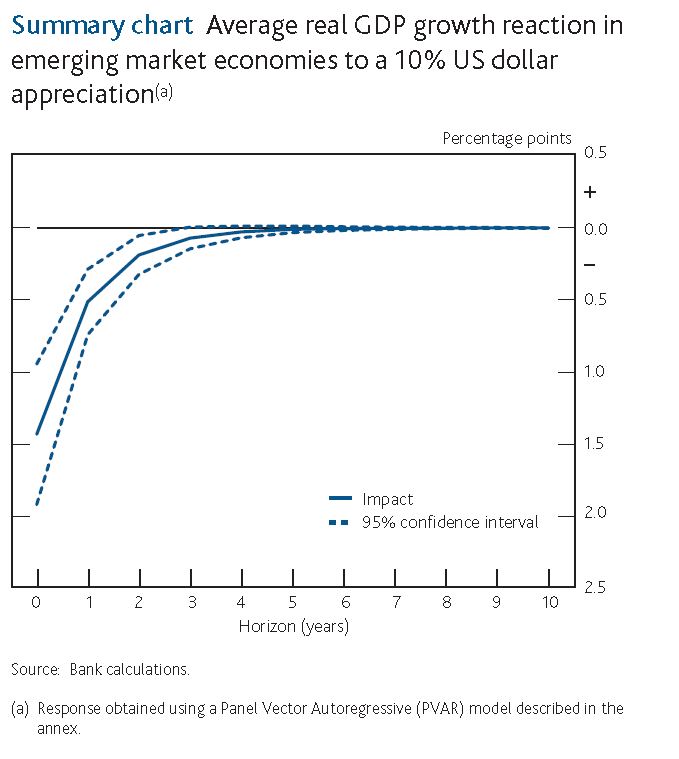

These global roles of the US dollar form channels through which changes in its value can have consequences outside US borders. These go beyond the standard effect on bilateral trade flows with the United States.

The traditional external trade channel would imply that when the US dollar appreciates against another country’s currency, the products of that country become more competitive relative to US products, boosting its exports and output. But if its exports are invoiced in dollars, that gain in competitiveness may not materialise. And if companies have borrowed in dollars, the amount of domestic currency needed to repay that debt will have increased, raising the burden of the debt, and acting as a drag on growth. By contrast, those who hold dollar assets, for example governments with large US dollar reserves, will experience a gain in wealth, which might support spending and hence growth. These various channels mean that it is not straightforward to estimate the impact of an appreciation of the dollar on the output growth of the rest of the world.