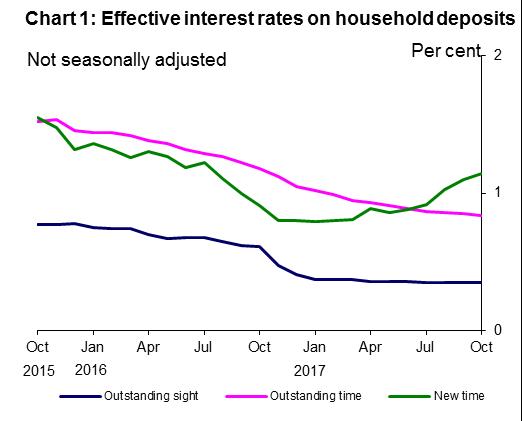

- Effective rates on new individual fixed-rate bond deposits have decreased by 14bps from 0.98% to 0.84%. Whilst rates on new individual ISAs have increased by 21bps from 1.26% to 1.47%; and

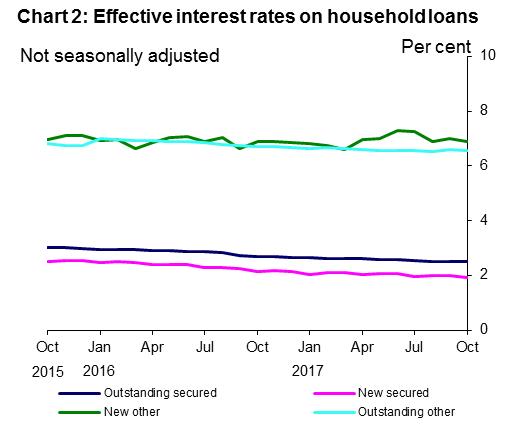

- Effective rates on new individual mortgages have decreased, floating mortgages by 9bps from 1.76% to 1.67% and fixed-rate mortgages by 5bps from 1.99% to 1.94%.

Table A: Effective interest rates paid/received on individual's balances by UK MFIs (excluding central bank)

Percent

Not seasonally adjusted

| Outstanding | New business | |||||||||

| Sight deposits |

Time deposits |

Other loans |

Secured loans |

Time deposits |

Other loans |

Secured loans | ||||

| Z6IQ | Z6IW | Z6KO | Z6K6 | Z6IH | Z6K5 | Z6JM | ||||

| 2017 | Jul | 0.36 | 0.87 | 7.16 | 2.55 | 0.93 | 7.46 | 1.95 | ||

| Aug | 0.35 | 0.86 | 7.12 | 2.53 | 1.04 | 7.05 | 2.00 | |||

| Sep | 0.36 | 0.85 | 7.15 | 2.52 | 1.11 | 7.18 | 1.97 | |||

| Oct | 0.36 | 0.84 | 7.11 | 2.50 | 1.15 | 7.03 | 1.92 | |||

Table B: Effective interest rates paid/received on PNFC balances by UK MFIs (excluding central bank)

Per cent

Not seasonally adjusted

| Outstanding | New business | ||||||

| Sight deposits |

Time deposits |

Loans | Time deposits |

Loans | |||

| HSCT | HSCU | HSDC | BJ72 | BJ82 | |||

| 2017 | Jul | 0.15 | 0.46 | 2.78 | 0.26 | 2.32 | |

| Aug | 0.15 | 0.44 | 2.79 | 0.24 | 2.39 | ||

| Sep | 0.14 | 0.42 | 2.81 | 0.29 | 2.41 | ||

| Oct | 0.14 | 0.43 | 2.82 | 0.31 | 2.39 | ||