Key findings

- The outstanding value of all residential mortgage loans increased by 0.9% from the previous quarter to £1,733.7 billion, and was 2.9% higher than a year earlier (Table A).1

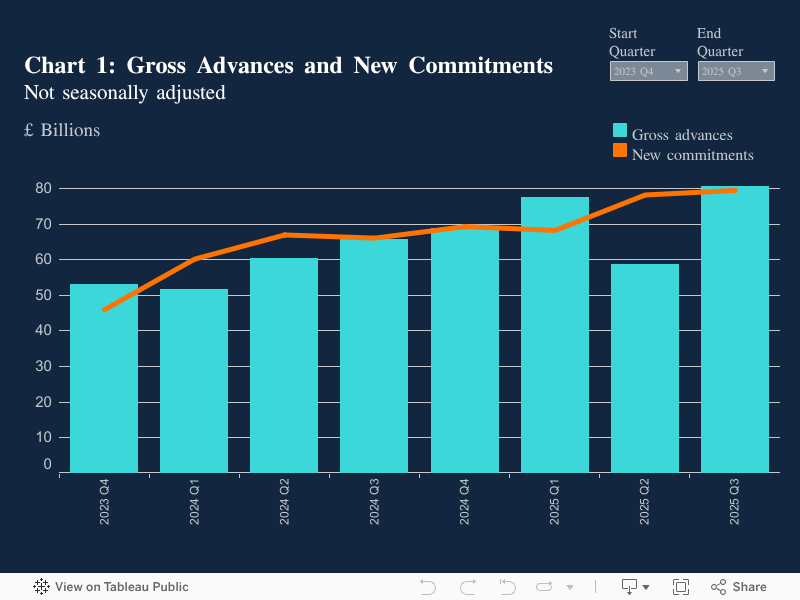

- The value of gross mortgage advances increased by 36.9% from the previous quarter to £80.4 billion, the largest increase in new advances since 2020 Q3, and was 22.7% higher than a year earlier (Table A and Chart 1).

- The value of new mortgage commitments increased by 1.6% from the previous quarter to £79.4 billion, the highest since 2022 Q3, and was 20.3% higher than a year earlier (Table A and Chart 1).

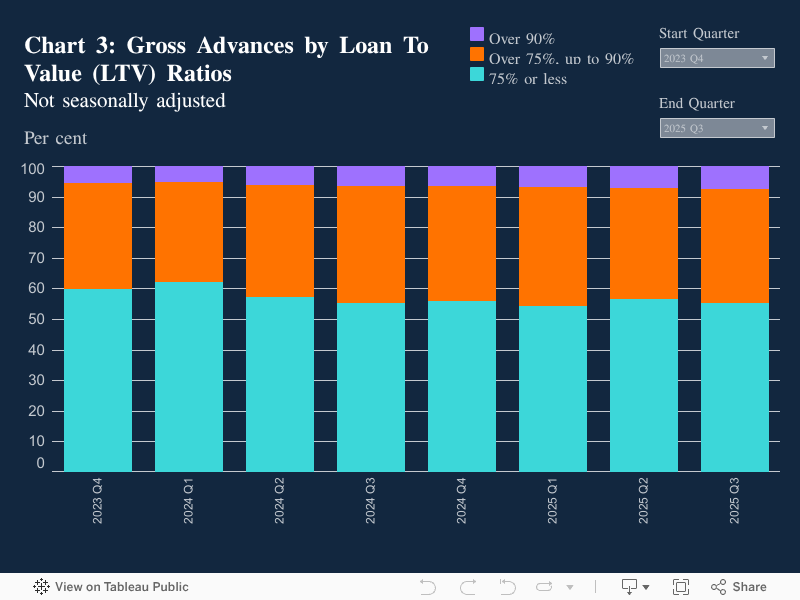

- The share of gross mortgage advances with loan-to-value (LTV) ratios exceeding 90% increased by 0.3 percentage points (pp) from the previous quarter to 7.4%, the highest share since 2008 Q2, and was 0.8pp higher than a year earlier (Chart 3).

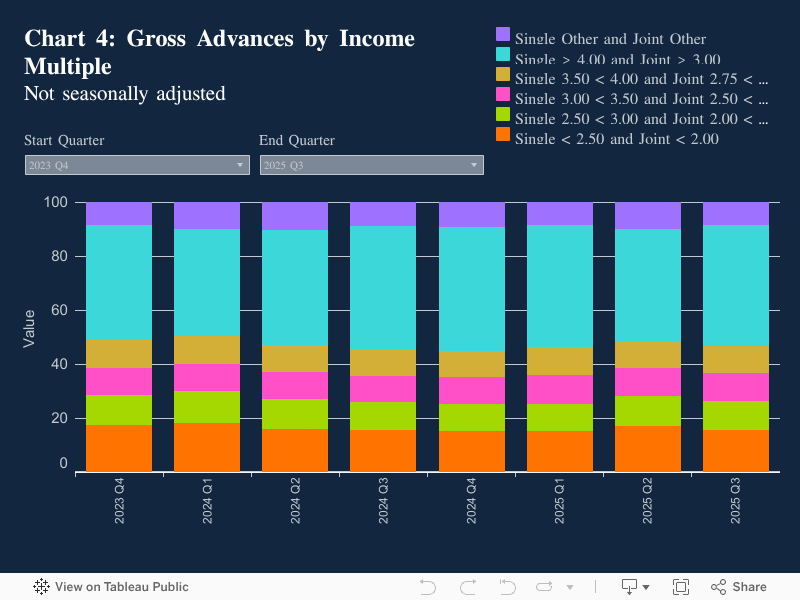

- The proportion of lending to borrowers with a high loan-to-income (LTI) ratio increased by 3.3pp from the previous quarter to 44.7%, the largest increase since 2020 Q3, but remained 0.6pp lower than a year earlier (Chart 4).

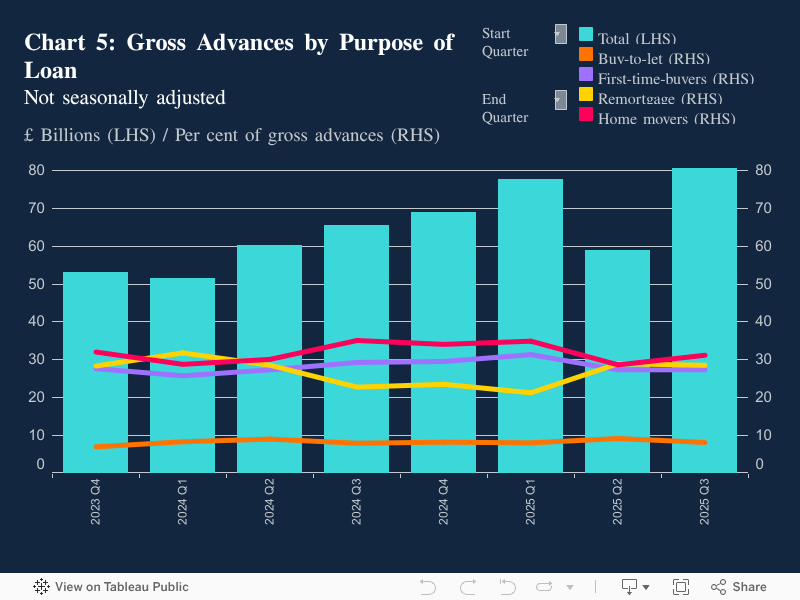

- The share of gross mortgage advances for house purchase for owner occupation increased by 2.5pp from the previous quarter to 58.6%, but remained 5.8pp lower than a year earlier. (Chart 5).

- The share of gross advances for remortgages for owner occupation decreased by 0.4pp from the previous quarter to 28.6%, but remained 5.8pp higher than a year earlier (Chart 5).

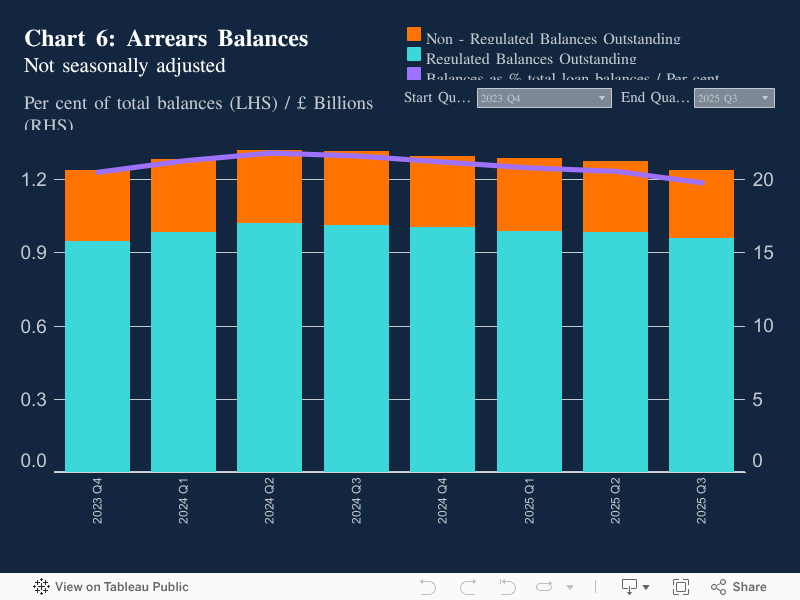

- The value of outstanding mortgage balances with arrears decreased by 2.9% from the previous quarter to £20.6 billion, and was 5.8% lower than a year earlier (Chart 6).

- The proportion of the total mortgage loan balances with arrears, relative to all outstanding mortgage balances, has stayed the same as the previous quarter at 1.2%, and was 0.1pp lower than a year earlier (Chart 6).

- The proportion of total outstanding balances with arrears that are new arrears cases decreased by 0.1pp from the previous quarter to 8.8%, the lowest since 2022 Q1, and was 0.9pp lower than a year earlier.

Table A: Residential loans to individuals, flows and balances

Regulated and non-regulated mortgages *

£ billions

Not seasonally adjusted

|

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

|

|

2023 |

2024 |

2025 |

||||||

|

Flows |

||||||||

|

Gross advances |

52.9 |

51.6 |

60.2 |

65.5 |

68.8 |

77.6 |

58.8 |

80.4 |

|

New commitments |

46.0 |

60.2 |

66.9 |

66.1 |

69.3 |

68.2 |

78.2 |

79.4 |

|

Amounts outstanding |

1,671.8 |

1,670.0 |

1,676.3 |

1,685.5 |

1,693.2 |

1,713.3 |

1,718.1 |

1,733.7 |

*This data covers regulated mortgage lending, and non-regulated mortgage lending by firms which undertake regulated mortgage lending or administration of regulated mortgages.

Graphical Analysis:

- The value of gross mortgage advances increased by 36.9% from the previous quarter to £80.4 billion, the largest increase in new advances since 2020 Q3, and was 22.7% higher than a year earlier (Table A and Chart 1).2

- The value of new mortgage commitments (lending agreed to be advanced in the coming months) increased by 1.6% from the previous quarter to £79.4 billion, the highest since 2022 Q3, and was 20.3% higher than a year earlier.3