Key findings

- The outstanding value of all residential mortgage loans increased by 0.3% from the previous quarter to £1,703.6 billion, and was 2.6% higher than a year earlier (Table A).1

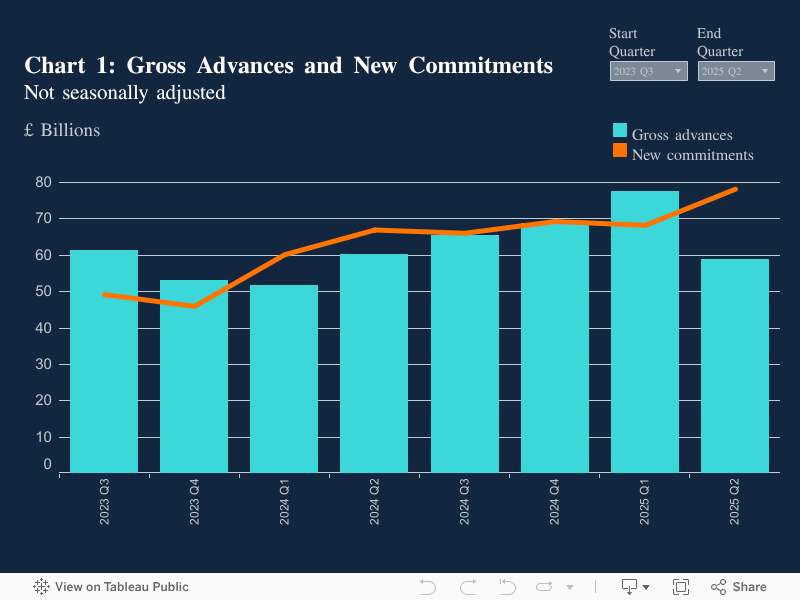

- The value of gross mortgage advances decreased by 24.2% from the previous quarter to £58.8 billion, the lowest since 2024 Q1, and was 2.4% lower than a year earlier (Table A and Chart 1).

- The value of new mortgage commitments (lending agreed to be advanced in the coming months) increased by 14.6% from the previous quarter to £78.2 billion, the highest since 2022 Q3, and was 16.8% higher than a year earlier (Table A and Chart 1).

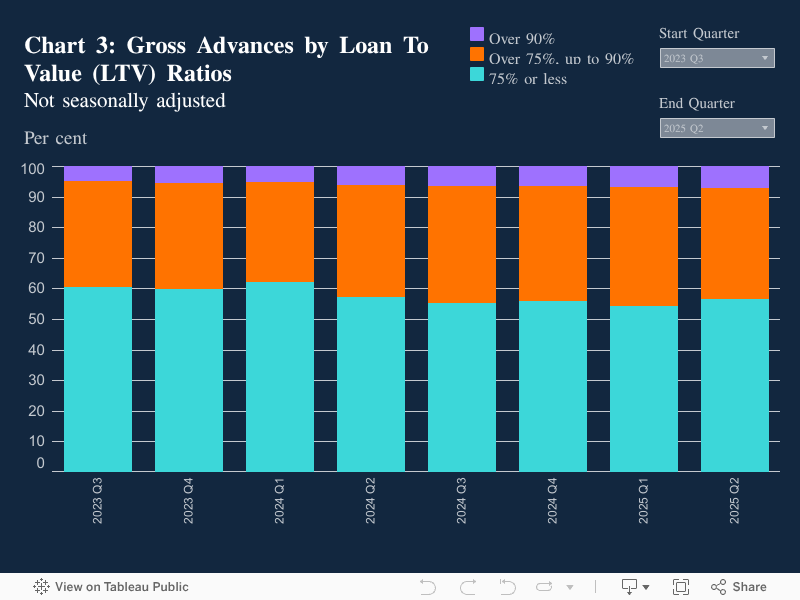

- The share of gross mortgage advances with loan-to-value (LTV) ratios exceeding 90% increased by 0.4 percentage points (pp) from the previous quarter to 7.1%, the highest share since 2008 Q2, and was 1.1pp higher than a year earlier (Chart 3).

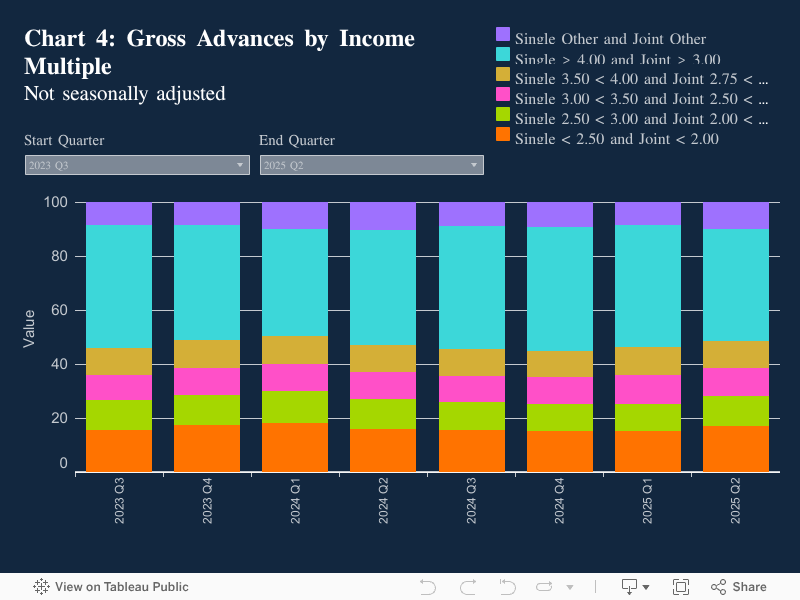

- The proportion of lending to borrowers with a high loan to income (LTI) ratio decreased by 3.7pp from the previous quarter to 41.5%, the largest decrease since 2023 Q1, and was 1.0pp lower than a year earlier (Chart 4).

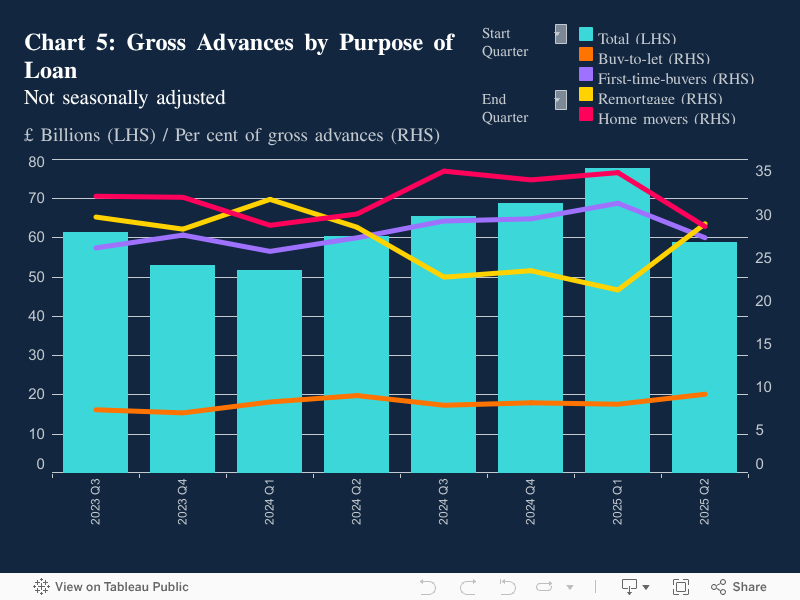

- The share of gross mortgage advances for house purchase for owner occupation decreased by 10.3pp from the previous quarter to 56.0%, the lowest share since 2024 Q1, and was 1.4pp lower than a year earlier (Chart 5).

- The share of gross advances for remortgages for owner occupation increased by 7.7pp from the previous quarter to 29.0%, the highest share since 2024 Q1, and was 0.4pp higher than a year earlier (Chart 5).

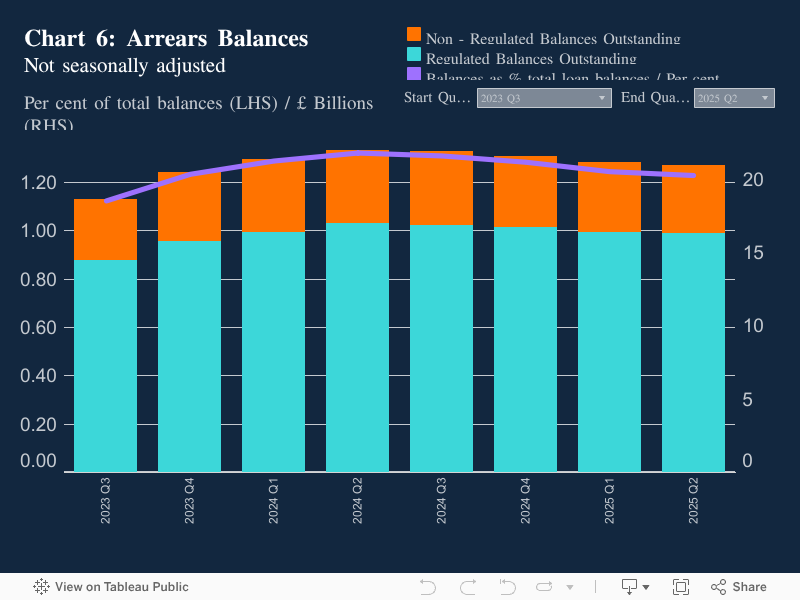

- New arrears cases (as a proportion of total outstanding balances with arrears) decreased by 0.4pp from the previous quarter to 8.8%, the lowest since 2022 Q1, and was 2.2pp lower than a year earlier.

- The value of outstanding mortgage balances with arrears decreased by 1.0% from the previous quarter to £20.9 billion, the lowest since 2023 Q4, and was 4.6% lower than a year earlier (Chart 6).

Table A: Residential loans to individuals, flows and balances

Regulated and non-regulated mortgages *

£ billions

Not seasonally adjusted

| Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | |

|---|---|---|---|---|---|---|---|---|

| 2023 | 2024 | 2025 | ||||||

| Flows |

||||||||

| Gross advances |

61.4 |

52.9 |

51.6 |

60.2 |

65.5 |

68.8 |

77.6 |

58.8 |

| New commitments |

49.2 |

46.0 |

60.2 |

66.9 |

66.1 |

69.3 | 68.2 |

78.2 |

| Amounts outstanding |

1,657.4 |

1,656.3 |

1,654.8 |

1,660.9 |

1,670.5 |

1,678.2 |

1,698.5 |

1,703.6 |

* This data covers regulated mortgage lending, and non-regulated mortgage lending by firms which undertake regulated mortgage lending or administration of regulated mortgages.

Graphical Analysis:

- The value of gross mortgage advances decreased by 24.2% from the previous quarter to £58.8 billion, the lowest since 2024 Q1, and was 2.4% lower than a year earlier (Table A and Chart 1).2

- The value of new mortgage commitments (lending agreed to be advanced in the coming months) increased by 14.6% from the previous quarter to £78.2 billion, the highest since 2022 Q3, and was 16.8% higher than a year earlier.3